In a Roth IRA, assessing risk is crucial. Options such as stocks, bonds, ETFs, mutual funds, and CDs should match our risk tolerance and objectives. Diversifying helps increase returns and decrease risk, which aligns with long-term goals. Monitoring investments regularly and making adjustments can lead to better outcomes. To grow a Roth IRA, it’s important to diversify across assets, reinvest dividends, and focus on high-growth sectors. Evaluating risk is crucial by balancing various asset classes and adapting to market changes. Remember, the responsibility of investing wisely lies with us. Explore investment strategies for a more prosperous retirement in the future.

Key Takeaways

- Roth IRA does not invest for you; you choose investments.

- Options include stocks, bonds, ETFs, mutual funds, and CDs.

- Actively select and manage investments based on goals.

- Diversify portfolio to minimize risk and maximize returns.

- Regularly review and adjust investments to align with strategy.

Understanding Roth IRA Investment Options

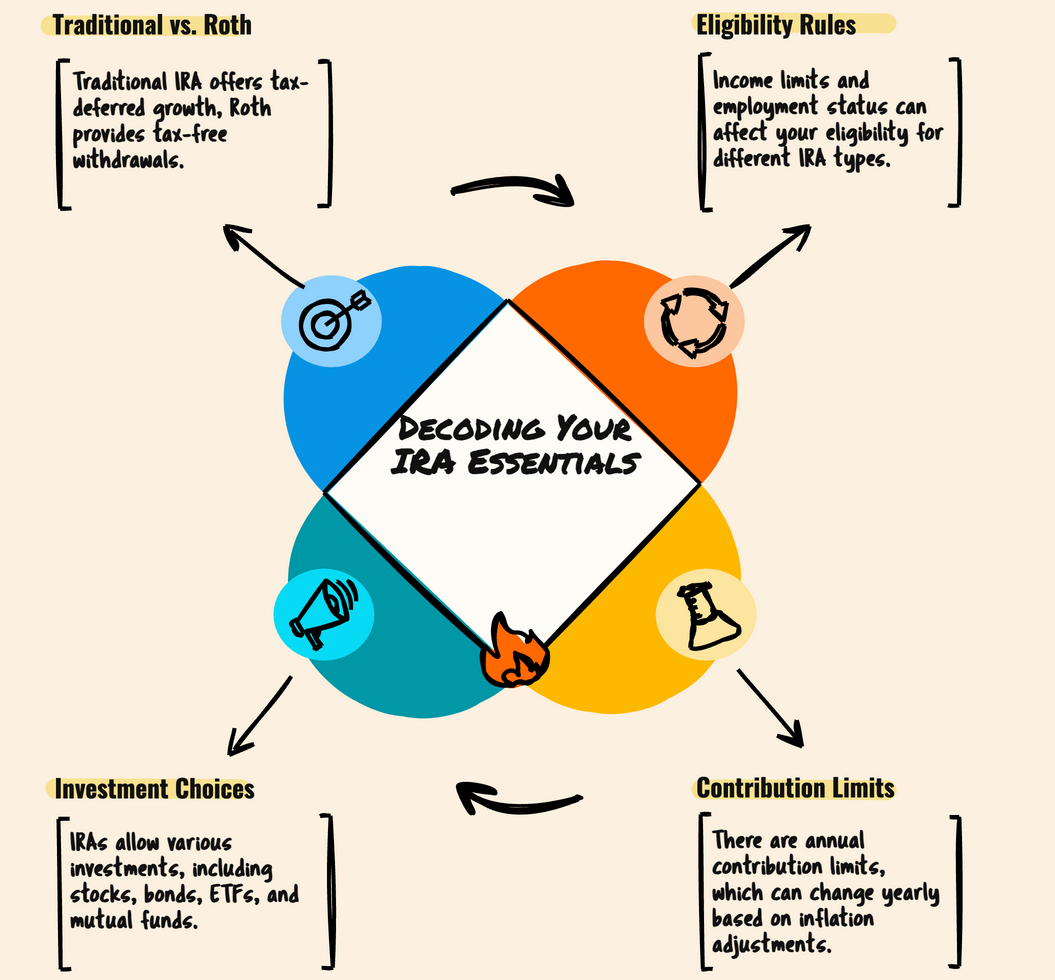

When we explore Roth IRA investment options, we encounter a diverse array of choices. Within a Roth IRA, investors can select from a range of investment vehicles such as stocks, bonds, ETFs, mutual funds, and CDs. This flexibility allows for customization based on our risk tolerance and financial goals.

It's important to take into account our long-term objectives and comfort level with risk when choosing Roth IRA investments. Diversifying our portfolio is vital to minimize risk and maximize potential returns.

Choosing Investments Within a Roth IRA

Within a Roth IRA, we're responsible for actively choosing our investments as the account doesn't automatically invest for us. When selecting investments for your Roth IRA, you have various options such as stocks, bonds, ETFs, mutual funds, and CDs.

It's important to align your investment choices with your risk tolerance and financial goals. Diversification is key within a Roth IRA to spread risk across different asset classes and sectors. By diversifying, you can help protect your investments from potential downturns in any single area of the market.

Regularly reviewing and adjusting your Roth IRA investments is essential to make sure they continue to align with your investment strategy over time. Stay informed about market trends and changes in your financial situation to make informed decisions about your Roth IRA investments. Remember, the choices you make within your Roth IRA can have a significant impact on your retirement savings, so it's important to choose wisely.

Managing Your Roth IRA Investments

As we navigate our Roth IRA investments, our active involvement in selecting and managing various investment options is essential for maximizing growth potential and aligning with our financial goals.

Within a Roth IRA account, we've the autonomy to manage our investments, choosing from a range of options such as stocks, bonds, ETFs, and mutual funds.

It's vital to regularly assess our investment portfolio, ensuring it remains in line with our financial objectives and risk tolerance levels. By monitoring the performance of our investments and making informed decisions based on market conditions and personal goals, we can optimize growth within our Roth IRA.

Strategies for Maximizing Roth IRA Growth

To maximize growth in your Roth IRA, employing a diversified portfolio of investments is essential. By spreading your funds across various asset classes such as stocks, bonds, and real estate, you can reduce risk and potentially increase returns over time.

Reinvesting dividends and interest earned from your investments allows you to take advantage of compounding growth, where your earnings generate more earnings. Consider allocating a portion of your Roth IRA funds to high-growth sectors like technology, which may offer significant returns in the long run.

It's important to regularly review and adjust your investment strategy to align with your financial goals and adapt to changing market conditions. Remember that one of the key benefits of a Roth IRA is the ability to make tax-free withdrawals after age 59½ and 5 years of account opening, so optimizing your investment choices can help you maximize growth and achieve your retirement objectives.

Evaluating Investment Risks in Roth IRA

Investors in a Roth IRA must actively assess and manage the risks associated with their chosen investments. Understanding the risk-return profile of each investment option is vital for optimizing growth within a Roth IRA. Diversification across various asset classes and risk levels can help mitigate potential risks. It is important to monitor investments regularly and adjust them based on changing market conditions and personal financial goals to maintain a balanced portfolio. By actively evaluating and managing risks, investors can work towards achieving their long-term financial objectives while safeguarding their retirement savings.

| Strategies for Managing Risks in Roth IRA | |

|---|---|

| Evaluate Risks | Monitor Investments |

| Assess risk-return profiles of investments | Regularly review holdings |

| Diversify Portfolio | Adjust Based on Goals |

| Spread investments across asset classes | Align investments with objectives |

Frequently Asked Questions

Does Money in a Roth IRA Get Invested?

Money in a Roth IRA does get invested. We choose investments like stocks, bonds, and funds based on our goals and risk tolerance. Our decisions impact how our account grows over time.

Does a Roth IRA Invest in the Stock Market?

Stock market investments are a key feature of a Roth IRA. We choose how to invest, aiming for growth. Tax benefits and compounding returns make it a powerful tool for long-term wealth building.

How Much Will a Roth IRA Grow in 20 Years?

In 20 years, a Roth IRA's growth potential depends on factors like investment amount, rate of return, and contribution consistency. With an average 7% return, it could double every 10 years, especially with reinvested dividends and a diversified strategy.

Is the Roth IRA the Best Way to Invest?

The Roth IRA offers unparalleled control over investments, allowing us to tailor portfolios to our preferences. With options like stocks, bonds, ETFs, and mutual funds, it's a versatile choice for long-term growth.

Can a Roth IRA Automatically Invest in Stocks for You?

Yes, a Roth IRA can automatically invest in stocks for you. With a roth ira stock investments, you can set up automatic contributions to a brokerage account, where the funds will be invested in stocks according to your chosen investment strategy. This allows for convenient, hands-off investing for your retirement savings.

Conclusion

To sum up, investing in a Roth IRA can be a smart way to save for retirement. By understanding your investment options, choosing wisely, and actively managing your portfolio, you can maximize growth potential.

Remember, it's important to evaluate risks and make informed decisions. With a bit of research and strategic planning, your Roth IRA can work for you in the long run.

So start investing today and secure your financial future!