Did you know that approximately 30% of Indonesia’s workforce is expected to be 55 years or older by 2030? This reality has raised significant questions regarding the early retirement age within the Indonesia private sector. As the country grapples with an aging population, understanding the framework of retirement age regulations is more crucial than ever. This article aims to shed light on the factors influencing early retirement age in Indonesia’s private sector, particularly how government policies and pension planning shape your future. With the landscape of retirement changing, it’s essential to equip yourself with the knowledge necessary to navigate these waters effectively.

Key Takeaways

- Understanding the implications of the early retirement age in Indonesia’s private sector.

- The influence of government regulations on retirement age and pension systems.

- Importance of proactive pension planning for your future.

- Impact of demographic shifts on retirement policies.

- Insights into how retirement age changes may affect your financial security.

Understanding the Current Retirement Age Regulations

The landscape of retirement age regulations in Indonesia is evolving, significantly impacting how individuals prepare for their future. Recent shifts in the retirement policy indicate a gradual increase in the retirement age from 56 to 65 by the year 2043. This change presents an important consideration for employees navigating their pension eligibility and future planning.

Understanding these retirement age regulations in Indonesia is crucial for workforce participants. The adjustments aim to align with global trends and the rising life expectancies observed in many populations. As a result, individuals may find themselves working longer than previous generations. Knowledge of these policies allows you to plan more effectively for retirement.

When contemplating your retirement journey, it is essential to keep abreast of the current regulations. Changes in retirement policies can directly influence your pension eligibility, retirement savings, and work-life balance. Ensuring you understand these aspects can empower you to make informed decisions about your career and financial future.

Government Regulations on Pension Security

Understanding the framework established by the Government Regulation No. 45 of 2015 proves essential for grasping how the Pension Security Program operates in Indonesia. This regulation lays the foundation for mandatory employee enrollment and sets specific guidelines that both employers and employees must follow.

Overview of Government Regulation No. 45 of 2015

Government Regulation No. 45 of 2015 marks a pivotal moment in the landscape of pension regulations. It mandates that employers enroll employees in the Pension Security Program, thereby addressing critical issues around retirement security. This regulation targets not only the protection of employees but also aims to establish a standard framework of employer obligations regarding pension contributions.

Details of the Pension Program Requirements

The Pension Security Program established under this regulation stipulates that employers are obliged to contribute a minimum of 3% of each employee’s monthly salary towards their pension. Anticipated increases in employer contributions up to 8% highlight the ongoing commitment to enhancing retirement benefits. Furthermore, to qualify for pension benefits, employees must maintain their enrollment for at least 15 years, a requirement that underscores the importance of long-term financial planning.

Implications for Employers and Employees

Both employers and employees experience significant implications from the regulations set by Government Regulation No. 45 of 2015. Employers face strict employer obligations and penalties for non-compliance, making it imperative for them to understand their roles within the Pension Security Program. Employees enjoy enhanced rights and security in their retirement planning. Knowing that their pensions are supported by mandatory contributions empowers them to look forward to a more secure financial future.

The Old Age Security Program in Indonesia

The Old Age Security Program serves as a pivotal safety net for employees in Indonesia’s private sector. This program complements existing pension benefits, ensuring individuals have a secure financial future upon retirement. Understanding the nuances of this program can significantly enhance your retirement planning.

What is the Old Age Security Program?

The Old Age Security Program is a crucial component of Indonesia’s social safety framework, aimed at providing financial support to individuals during their later years. Established under Government Regulation No. 46 of 2015, it serves to strengthen the Pension Security Program for both salary and non-salary earners. Employees contribute 5.7% of their monthly salary, while employers contribute an additional 3.7%. This system is designed to ensure that private sector employees receive a lump-sum benefit at retirement or under specific conditions.

How it Affects Private Sector Employees

The implications of the Old Age Security Program are significant for private sector employees. By participating, you not only secure your future but also benefit from structured savings through your contributions. Understanding the details of this program facilitates better retirement strategy planning. Without adequate knowledge of the Old Age Security Program, achieving optimal pension benefits may become challenging.

Impact of the Retirement Age Increase on Workers

The recent proposals to increase the retirement age in Indonesia aim to address various social and economic challenges. As the country transitions from a current retirement age of 56 years to 59 years by 2025, and ultimately to 65 years, these changes have significant implications for workers. This retirement age increase aligns with projected improvements in overall life expectancy, which is expected to reach 74 years by 2024. Understanding these adjustments is crucial for both employees and employers as they navigate the shifting landscape of the workforce.

Current and Future Retirement Age Changes

Raising the retirement age will have profound workforce implications. Workers must reconsider their career trajectories, financial planning, and health management strategies. As the retirement age rises, employees will be required to contribute longer to their pension plans, generating a more sustainable economy. The adjustment from 56 to 59 years exemplifies an initial yet critical step toward a future where a 65-year retirement age may become the norm. Employers might need to adapt their policies to accommodate longer tenures and diverse workforce dynamics.

How Changes Reflect on Life Expectancy Trends

The link between the retirement age increase and rising life expectancy cannot be overstated. With people living longer healthier lives, it is essential to tailor retirement policies to reflect these changes. This approach encourages older workers to remain active in the workforce, tapping into their experience while maintaining their financial well-being. Adjusting retirement ages based on life expectancy not only enhances economic stability but also fosters a culture where lifelong learning and adaptability become standard practices.

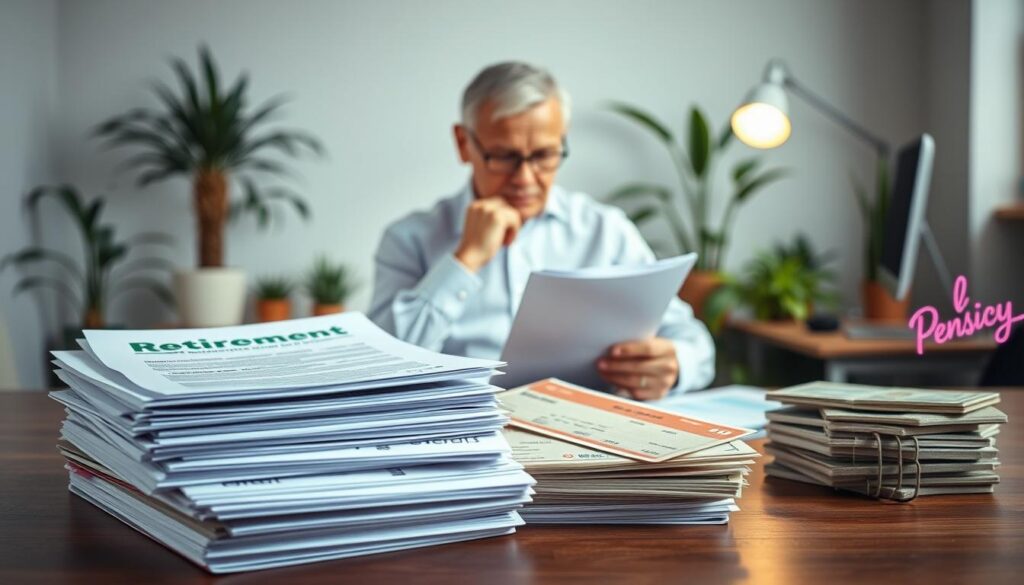

Early Retirement Age for Private Sector in Indonesia

In the dynamic environment of the private sector Indonesia, early retirement options attract many employees contemplating a shift in their career trajectories. While the standard retirement age is established by government regulations, individuals may explore specific routes for early retirement. These options often hinge on years of service, financial stability, and personal circumstances.

Planning for retirement, particularly in the context of early retirement, necessitates a robust understanding of the associated policies. It’s imperative for you to consider how your retirement planning aligns with the requirements stated in the government regulations. Early retirees typically face restrictions regarding the access to pension funds, which remain locked until they reach the official retirement age.

This scenario underlines the importance of seeking advice and guidance on financial planning. Navigating these choices effectively ensures that you maximize your benefits while meeting all criteria set forth for early retirement in the Indonesian private sector. Understanding these nuances can make the transition to retirement smoother, appealing, and financially viable.

| Factors Influencing Early Retirement | Impact on Pension Funds | Action Steps |

|---|---|---|

| Years of Service | Access delay until retirement age | Consult with a retirement planner |

| Financial Readiness | Adjustments in savings strategy | Evaluate retirement savings options |

| Health Considerations | Pension accessibility impacts | Plan health coverage |

Pension Security Contributions and Their Effects

Pension contributions play a crucial role in ensuring that employees secure their financial futures during retirement. Understanding the structure and implications of these contributions benefits both workers and employers. Awareness of contribution rates and the consequences of delayed payments helps maintain compliance with employer responsibilities and protects employee interests.

Contribution Rates Explained

In Indonesia, pension contributions are mandated at a rate of 3% from employees and 2% from employers. These rates may increase if individual employee salaries exceed certain caps, which ensures contributions remain proportional to an employee’s earnings. Timely and consistent contributions are essential for building a reliable retirement fund.

Consequences of Delayed Contributions

Employers face financial penalties for delayed pension contributions. These penalties can significantly impact an organization’s finances and reputation. Adherence to timely payments mitigates risks associated with legal repercussions and reinforces the importance of fulfilling employer responsibilities. Consistent contributions safeguard the future benefits of employees, ensuring their retirement needs are met.

Types of Pension Benefits Available

Understanding the various types of pensions can significantly aid private sector employees in planning for their future. Each type of pension serves a unique purpose, ensuring that individuals have financial support during different life circumstances. The primary benefits include the old age pension, disability benefits, and survivor benefits, each with specific eligibility criteria and features.

Old Age Pension

The old age pension provides financial assistance to individuals who are retiring after years of service. Eligibility usually requires a minimum number of contribution years. The benefits you receive may depend on your employment history and contributions made over time.

Disability Pension

Should you face a life-altering disability, disability benefits offer vital support. This pension aims to help individuals who can no longer work due to health issues. Applicants generally need to provide medical documentation and prove their disability status to qualify.

Survivor Benefits

In the unfortunate event of an employee’s death, survivor benefits provide financial security for dependents. These benefits often extend to spouses and children, ensuring that the family can cope with the loss of the primary earner. Eligibility for survivor benefits focuses on the deceased’s contribution history and relationship to the survivors.

The Role of BPJS Ketenagakerjaan in Retirement Planning

Understanding the role of BPJS Ketenagakerjaan is essential for effective pension planning. This organization is not just a regulatory body but a key player in your retirement programs. Knowing its responsibilities and offerings helps you prepare for a secure financial future.

Key Responsibilities of BPJS Ketenagakerjaan

BPJS Ketenagakerjaan is responsible for managing employee benefits, ensuring that workers have access to necessary resources for retirement. Its primary duties include:

- Administering various pension programs tailored for different professional needs.

- Collecting contributions to fund the retirement programs effectively.

- Providing clear and timely information regarding benefit entitlements and claims processes.

What to Expect from BPJS Programs

When you engage with BPJS Ketenagakerjaan, you can anticipate several advantages that will enhance your retirement experience. Expect:

- Regular updates and communication about your pension planning status.

- Efficient processing of claims, making it easier for you to access your benefits.

- Support and guidance from trained professionals, helping you navigate your options.

Being informed about BPJS Ketenagakerjaan can empower you to make better choices regarding your retirement planning and ensure that you are prepared for the future.

Challenges in Accessing Pension Funds

Accessing pension funds presents various challenges for private sector employees. Navigating these hurdles can be daunting, as many workers face complicated procedures that often delay their financial security. Identifying these barriers is crucial for you to effectively manage your retirement plans and ensure you receive the benefits to which you are entitled.

Barriers for Private Sector Employees

One significant barrier includes bureaucratic inefficiencies, which can slow down the processing of pension claims. Employees often encounter long waiting times for approvals, leading to financial uncertainty during retirement. In addition, the lack of clear communication from pension funds can further complicate matters. Workers might find it challenging to understand the necessary steps for accessing pension funds, especially if they are unfamiliar with the system.

Understanding the Impact of Statutory Requirements

Complex statutory requirements often add to the challenges of accessing pension funds. Regulations can differ significantly depending on the type of pension plan, making it essential for employees to comprehend their specific obligations. These requirements can include minimum age limits, contribution history, and documentation needed for claims. You must navigate these intricate regulations to ensure compliance and avoid potential delays in accessing funds during retirement.

Voluntary Pension Schemes and Their Importance

Voluntary pension schemes offer a vital opportunity for workers to supplement their retirement savings beyond mandatory contributions. These plans are essential for effective financial planning, empowering you to establish a more secure financial future. Engaging in voluntary pension schemes allows you to tailor your retirement strategy according to your unique goals, which can lead to enhanced financial independence in your later years.

By participating in these schemes, you gain flexibility in how much you can save. Unlike mandatory pension programs, voluntary options enable you to decide the level of contribution based on your current financial situation and future aspirations. This personalized approach can significantly improve your overall retirement savings, helping you to achieve the lifestyle you desire during retirement.

Voluntary pension schemes are especially beneficial in a rapidly changing economic environment. Investing additional funds into these schemes can provide a safety net, protecting you against unexpected financial challenges. As a result, they play a crucial role in bolstering your financial security, making them an indispensable component of your overall retirement strategy.

Economic Implications of Increasing Retirement Age

The decision to increase the retirement age carries significant economic implications for both individuals and the nation. By retaining older workers in the workforce, we can potentially stimulate economic growth while simultaneously encouraging higher workforce participation rates. This transition invites a host of challenges and opportunities that require careful consideration.

Impact on National Economic Growth

Raising the retirement age can contribute to overall economic growth. Older workers bring valuable experience and skills, which enhances productivity, thereby bolstering national output. A larger workforce can lead to increased consumer spending, further benefiting various sectors of the economy. Additionally, a decrease in the dependency ratio may result as more individuals remain employed longer, allowing for better financial sustainability within social security programs.

Balancing Workforce Participation with Economic Stability

Although older workers can enhance workforce participation, this must be balanced with opportunities for younger individuals entering the job market. Ensuring that the increasing retirement age does not impede access to jobs for younger workers is crucial. Policymakers must strategize to create pathways for youth employment while maximizing the contributions of older employees. This balance is vital for maintaining economic stability and fostering intergenerational collaboration within the workforce.

Conclusion

In summary, understanding the intricacies of retirement planning in Indonesia is essential for private sector employees. The regulations surrounding the retirement age, as well as the various pension security programs available, are crucial elements that influence your future of retirement. By staying informed about these regulations and the benefits they offer, you can make better decisions for your financial security.

The changes in retirement age policies and their implications make it even more vital to proactively assess your retirement strategies. Whether it involves contributing to pension schemes or exploring voluntary options, every decision you make today can significantly impact your future of retirement. Taking charge of your pension security ensures you are prepared for whatever lies ahead.

As you navigate these changes, remember that the landscape of retirement in Indonesia is evolving. Engaging with available resources and understanding your options will empower you to create a secure financial future. Make the most of your retirement planning Indonesia efforts today, ensuring you can enjoy your golden years with confidence and peace of mind.