When preparing for retirement, it is recommended to utilize a historical average inflation rate to forecast our expenses. Traditionally, financial advisors propose using a 2.5% inflation rate over a 30-year period to anticipate future costs. However, recent spikes in inflation rates, such as the 9.1% recorded in 2022, highlight the importance of considering short-term trends. Striking a balance between past and current inflation rates is crucial for making well-informed decisions. Adjusting our savings and investment strategies based on these rates is essential for securing our financial futures. Understanding how inflation impacts retirement planning is essential for making prudent financial decisions. For more insights on the effects of inflation on retirement, consider delving deeper into the subject.

Key Takeaways

- Consider historical average CPI of 2.5% for long-term projections.

- Acknowledge short-term high rates for current planning needs.

- Consult professionals to determine suitable inflation rates.

- Balance risks with conservative inflation assumptions.

- Regularly adjust retirement plans to counteract inflation's impact.

Importance of Considering Inflation in Retirement

When planning for retirement, we must prioritize considering the impact of inflation to safeguard our financial security. Inflation can diminish the purchasing power of retirees, making it important to account for rising costs in healthcare, including Medicare premiums. These expenses often surge at a faster rate than the general Consumer Price Index, impacting retirees' budgets greatly. Individuals on fixed incomes face the challenge of dwindling spending power as prices escalate, highlighting the necessity of factoring in inflation when preparing for retirement.

Moreover, the erosion of purchasing power due to inflation poses a substantial risk to retirees and those approaching retirement age. Even with Social Security benefits receiving an 8.7% cost-of-living adjustment in 2023, retirees must remain vigilant about how inflation can affect their financial well-being in the long term. By acknowledging the impact of inflation on retirement savings and income, individuals can better equip themselves to navigate financial challenges and maintain their standard of living during their retirement years.

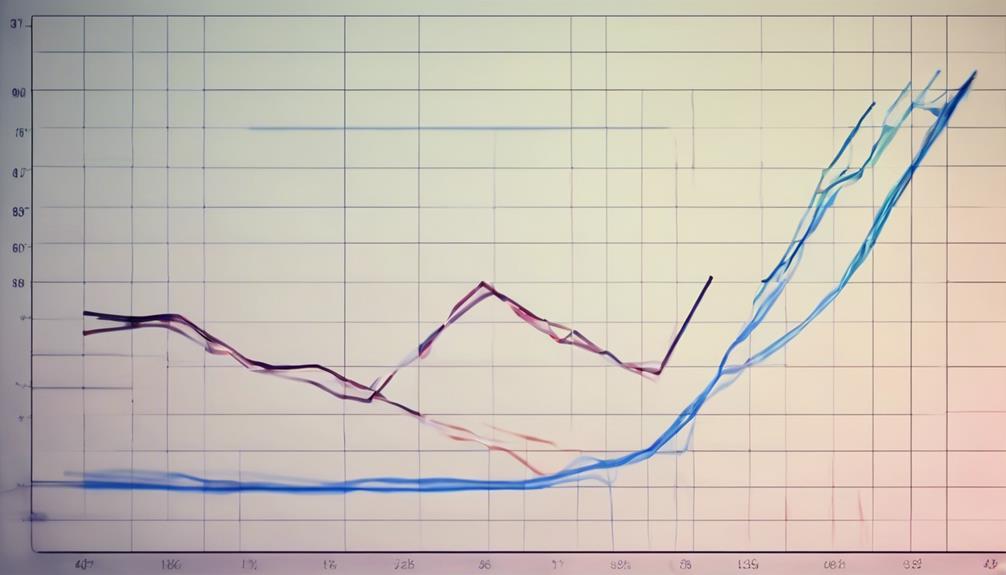

Historical Vs. Current Inflation Rates

When comparing historical and current inflation rates, we observe fluctuations that can impact retirement planning. Understanding how past rates differ from present ones is essential for making informed financial decisions.

Additionally, analyzing future inflation trends can help us anticipate potential challenges in our retirement savings strategies.

Past Vs. Present Rates

Comparing historical and current inflation rates is essential for gaining insights into the evolving landscape of retirement planning. The historical average Consumer Price Index (CPI) over the last 30 years sits at 2.5%, commonly utilized in retirement expense projections.

However, in 2022, the annual inflation rate peaked at 9.1%, greatly surpassing this long-term average. Over the last two decades, the average inflation rate has been 2.25%, reflecting recent trends. Advisors often rely on a 30-year average inflation rate of 2.5% to project retirement expenses accurately.

Impact on Planning

Considering both historical and current inflation rates is essential for making informed decisions in retirement planning. When comparing historical data with current inflation trends, it becomes evident that the impact on planning can be significant. Below is a table illustrating the differences between historical average inflation rates and the recent spike in inflation:

| Historical Data | Current Inflation Trends | |

|---|---|---|

| Average Rate | 2.25% (20 years), 2.5% (30 years) | 6.5% in 2022, peak 9.1% in June 2022 |

| Use in Projections | Often use 30-year average of 2.5% | Requires consideration for short-term high rates |

Understanding how these inflation rates affect financial projections can help individuals better prepare for retirement by adjusting savings goals and investment strategies accordingly.

Future Inflation Trends

Let's now shift our focus to the current subtopic of 'Future Inflation Trends' by examining the contrast between historical and current inflation rates. Historical averages suggest a 2.25% inflation rate over the last 20 years and around 2.5% over the last 30 years. However, in 2022, inflation spiked to 9.1%, averaging 6.5% for the year, notably higher than the historical norms.

When considering long-term retirement planning, the 100-year Consumer Price Index (CPI) average of 3.21% becomes essential. To accommodate potential future trends, financial advisors often use a conservative 30-year inflation rate of 2.5% for retirement projections. It's important to grasp both historical and current inflation rates to accurately plan for retirement, mitigating potential purchasing power erosion and considering long-term implications.

Factors Influencing Inflation in Retirement

Factors influencing inflation in retirement include:

- The impact of rising retirement expenses

- The effects of economic trends on inflation rates

- The consideration of appropriate investment strategies

Understanding how retirement expenses are affected by inflation is important for maintaining purchasing power in retirement. Economic shifts can greatly influence the inflation rate, making it essential to adapt investment strategies accordingly.

Retirement Expenses Impact

When planning for retirement, it is essential to recognize the significant impact that rising healthcare costs and fluctuating housing expenses can have on one's financial outlook. Healthcare costs tend to rise faster than general inflation, affecting retirement expenses significantly. Housing expenses can vary, not always aligning with typical inflation rates, which can disrupt retirement budgeting. The Consumer Price Index (CPI) may not accurately reflect retirees' expenses, requiring a conservative approach to inflation estimates. Inflation's impact on essential expenses like food, utilities, and transportation varies, influencing retirement planning strategies. Understanding specific factors influencing inflation in retirement, such as healthcare, housing, and daily living costs, is crucial for accurate planning.

| Factors Influencing Inflation in Retirement | |

|---|---|

| Healthcare Costs | Rise faster than general inflation |

| Housing Expenses | Can vary, impacting budgeting |

| Consumer Price Index (CPI) | May not reflect retirees' expenses |

| Essential Expenses | Inflation impacts food, utilities, transportation |

Economic Trends Affect

Considering economic trends that affect inflation in retirement is essential for accurate financial planning. Factors such as government policies, healthcare costs, and overall economic stability can have a substantial impact on the inflation rate. Government decisions on monetary policies and regulations can influence how prices fluctuate over time, directly impacting your purchasing power during retirement.

As healthcare costs continue to rise, they play an important role in determining the overall inflation rate that retirees may face. Understanding these economic trends is crucial for predicting future expenses and ensuring that your retirement savings can sustain your lifestyle.

Investment Strategies Consider

As we explore investment strategies to contemplate in retirement, it's important to acknowledge the significant influence that inflation can have on financial planning.

When considering retirement projections, historical inflation rates like the 30-year average of 2.5% can provide a useful starting point. It's essential to factor in the impact of inflation on investment returns when choosing strategies and evaluating how different asset classes perform against inflation.

Implications of Ignoring Inflation for Retirement

By neglecting the impact of inflation in retirement planning, we risk jeopardizing our financial security and ability to sustain our desired lifestyle. Disregarding inflation can lead to underestimating future expenses, running out of money prematurely, and facing financial insecurity.

Inflation erodes the purchasing power of savings, making it challenging to maintain our standard of living over time. Utilizing a conservative inflation rate assumption of 2-3% is common in retirement planning to account for price increases. Failing to take into account inflation can leave retirees struggling to cover rising costs, highlighting the importance of integrating it into our retirement projections.

Inflation's compounding effect on expenses further emphasizes the need to incorporate it into our financial plans.

Strategies for Adjusting Retirement Plans

When contemplating retirement plans, it's crucial to contemplate the impact of inflation on savings and withdrawal rates.

By taking into account a conservative inflation rate and adjusting based on individual housing situations, one can better prepare for long-term financial stability.

Ensuring a balance between investment returns and inflation rates is key to achieving retirement goals.

Inflation Impact on Savings

Regularly reviewing and adjusting our retirement plan is vital to mitigating the impact of inflation on our savings. When considering inflation impact on savings, it's important to factor in healthcare cost inflation, which often rises faster than general inflation rates.

To guarantee our retirement savings targets remain on track, adjustments should be made to accommodate a potential inflation gap of 2-3%. By understanding the long-term effects of inflation on purchasing power, we can make informed decisions about our retirement savings.

Stay proactive in monitoring and adapting your retirement plan to combat the erosion of your savings' value over time. Being proactive and staying informed will help safeguard your financial future against the impact of inflation.

Adjusting Withdrawal Rates

To maintain the sustainability of retirement income, consider adjusting withdrawal rates based on actual inflation rates. A flexible withdrawal strategy is essential to adapt to changing inflation trends and preserve purchasing power. Historical average inflation rates can guide withdrawal adjustments for sustainable retirement income. Regularly reviewing and updating withdrawal rates to align with current inflation rates is vital for effective retirement planning. Below is a table illustrating the importance of adjusting withdrawal rates to navigate varying inflation rates:

| Adjusting Withdrawal Rates | Sustainable Retirement Income | Flexible Withdrawal Strategy |

|---|---|---|

| Adapting to inflation trends | Ensuring long-term financial security | Responding to changing economic conditions |

Impact of Inflation on Retirement Income

In retirement planning, understanding the impact of inflation on retirement income is paramount for ensuring financial stability in the long term. Inflation can gradually diminish the purchasing power of savings and investments, affecting the ability to uphold one's desired lifestyle during retirement.

While using a conservative inflation rate of 2-3% is typical for retirement projections, higher inflation rates can result in elevated costs that may challenge financial security. Healthcare expenses, known to escalate faster than general inflation, play a significant role in retirement income planning.

Adjusting retirement income with regards to inflation is fundamental for sustaining financial security throughout retirement. By acknowledging the potential erosion of purchasing power due to inflation, individuals can make informed decisions to safeguard their retirement income and maintain a comfortable standard of living.

Planning ahead and incorporating inflation considerations can help mitigate the adverse effects of rising costs, ensuring a more financially secure retirement.

Inflation-Proofing Your Retirement Savings

To safeguard your retirement savings against the erosive effects of inflation, consider implementing proven strategies that can help secure your financial future. Start by factoring in a conservative inflation rate of around 2.5% for accurate retirement projections.

Keep in mind the potential impact of healthcare cost inflation, which often rises faster than general inflation during retirement. Utilize tools like Treasury Inflation-Protected Securities (TIPS) to shield your savings from inflation.

Regularly adjust your retirement budget to counteract inflation's impact on your purchasing power. Diversify your investment portfolio with assets that historically outperform inflation, such as real estate or stocks.

Evaluating Inflation Risk in Retirement

Taking into account the impact of inflation on retirement savings is essential for evaluating long-term financial risks.

When evaluating inflation risk in retirement, it's important to ponder the historical average of 2.5% over the last 30 years. Rising prices can erode the purchasing power of your savings, highlighting the need for conservative inflation assumptions in retirement planning.

Using a lower inflation rate may underestimate future expenses, while a higher rate could lead to overly cautious projections. Seeking professional advice can help determine the most suitable inflation rate for your retirement strategy, balancing the potential risks involved.

Tools for Calculating Inflation in Retirement

How can we effectively utilize online tools and calculators to project inflation rates for retirement planning? When considering retirement projections and the impact of inflation on purchasing power, utilizing online tools can provide valuable insights. Here are five innovative ways to leverage online resources for calculating inflation in retirement:

- Utilize inflation calculators: Online tools can help estimate future inflation rates based on historical data, offering a starting point for retirement planning.

- Explore retirement planning platforms: Some platforms offer sophisticated calculators that factor in inflation, investment strategies, and personal financial goals to provide tailored projections.

- Consider risk tolerance assessments: Online tools can help determine how inflation may affect different investment strategies based on individual risk tolerance levels.

- Engage with online retirement communities: Platforms where retirees share experiences can offer insights on how inflation impacts purchasing power and investment decisions.

- Seek expert advice: Online consultations with financial advisors can help tailor inflation rate projections to individual circumstances and economic outlook.

Monitoring and Adjusting Inflation Estimates

Consistently monitoring and adjusting inflation estimates is crucial for maintaining accurate retirement planning projections. By staying informed about the Consumer Price Index (CPI) trends, individuals can make more precise calculations for their retirement savings. It is advisable to assess inflation estimates annually and make necessary adjustments to financial plans to adapt to changing economic conditions. To assist in visualizing the impact of inflation on retirement planning, consider the following table:

| Aspect | Importance | Action |

|---|---|---|

| CPI Monitoring | Stay informed about inflation trends | Regularly check CPI for accurate estimates |

| Housing Costs | Significant impact on retirement budgets | Factor in housing cost increases for realistic plans |

| Personal Factors | Customize inflation assumptions | Consider personal lifestyle for tailored calculations |

When crafting retirement calculations, utilizing a 30-year average inflation rate of 2.5% as a baseline can provide a starting point for modeling. Remember to evaluate housing costs and individual factors to create personalized inflation assumptions that align with your retirement goals. Adaptable retirement models that consider inflation changes, tax rates, expenses, and investment returns guarantee a more precise financial outlook.

Frequently Asked Questions

What Inflation Should I Assume for Retirement Planning?

When planning for retirement, it's vital to contemplate the inflation rate we assume. A common approach is using a conservative estimate like 2.5% for projections. This allows us to account for potential changes in purchasing power over time.

What Growth Rate Should I Use for Retirement Planning?

For retirement planning, we recommend a growth rate of 6-8% to align with long-term financial goals. This range considers inflation and historical S&P 500 performance. Adjustments based on risk tolerance and market conditions can refine projections.

It's important to incorporate inflation, market fluctuations, and personal objectives when selecting a growth rate. Tailoring this rate to your unique circumstances guarantees a more accurate retirement savings forecast and helps achieve financial security.

What Is a Good Interest Rate to Use for Retirement Planning?

For retirement planning, we suggest considering an inflation rate around 3% to account for uncertainties. Historical averages range between 2.25% to 3.21%, guiding our projections.

Using lower rates like 2% for thorough estimates can also be beneficial. Adjusting plans for various inflation scenarios offers an all-encompassing view.

Consult a financial advisor for personalized advice based on your circumstances.

What Inflation Rate Do Financial Advisors Use?

When considering inflation rates for retirement planning, financial advisors commonly rely on a 30-year average around 2.5%. This figure helps project future costs, setting realistic savings goals.

By using historical trends, advisors create models that account for purchasing power erosion over time. Consistency in inflation rates aids in accurate long-term financial planning and goal setting.

It's an essential tool in ensuring our retirement plans are well-prepared for the future.

What is the Ideal Inflation Rate to Consider for Retirement Planning?

When considering retirement planning, it’s important to factor in the ideal inflation rate to ensure your savings can withstand rising costs. By maximizing retirement return rate, you can aim for a higher return on investment that outpaces inflation, helping to preserve the purchasing power of your savings in retirement.

Conclusion

To summarize, it's vital to take inflation into account when planning for retirement.

A study found that over the past 20 years, the average annual inflation rate in the United States was around 2.2%.

This statistic underscores the importance of factoring in inflation to make sure that your retirement savings will be able to cover rising costs and maintain your standard of living over time.

Stay informed and proactive in adjusting your retirement plans to account for inflation risk.