You know that Bitcoin's rapid rise has caught many off guard. The Czech Central Bank's chief highlights a critical issue: our understanding of this cryptocurrency just isn't keeping pace. With institutional interest growing, the need for clear regulations becomes even more pressing. What does this mean for the future of Bitcoin and its role in your investment strategy? There's more to unpack as the landscape continues to shift.

Why does understanding Bitcoin often lag behind its rapid price fluctuations? The world of cryptocurrency moves incredibly fast, leaving many people struggling to catch up. One key reason for this is the volatility in Bitcoin's pricing, which is often driven by speculation.

Understanding Bitcoin often trails its swift price changes, with volatility largely fueled by speculation in the fast-paced crypto landscape.

You see, Bitcoin doesn't just fluctuate randomly; it follows specific patterns that can be analyzed using models like the Autoregressive Distributed Lag (ARDL). These models help capture both short-term and long-term effects of various factors influencing the price. However, the non-stationarity of Bitcoin's time series data complicates things. Analysts often have to transform variables into first differences and run tests like the Augmented Dickey-Fuller to ensure reliable results.

Moreover, the challenge of high-frequency data makes it even harder to keep pace with Bitcoin's price movements. Tick-by-tick data, which provides insights into price changes every second, reveals that Bitcoin usually leads other cryptocurrencies in price movements. But this lead isn't static; it's been declining over time. Surprisingly, studies show that this lead time averages about 57 seconds, but it's decreasing, indicating a shift in market dynamics.

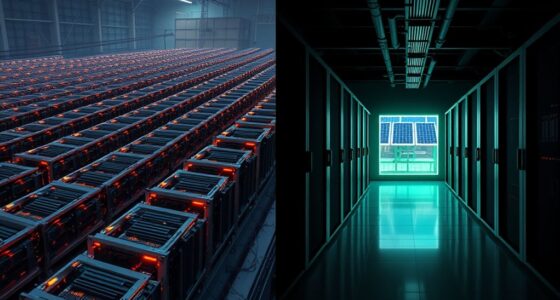

The Czech Central Bank's recent analysis highlights another layer of complexity. As institutions start to engage with Bitcoin, the need for regulatory clarity becomes paramount. Central banks are becoming increasingly involved in the regulation of cryptocurrencies, reflecting a shift in financial landscapes.

They're cautious, though, initially shelving significant Bitcoin allocations in favor of a more measured approach. This is vital for understanding Bitcoin's role in asset diversification but also shows the hesitance to fully embrace it.

Despite the chaos, Bitcoin is increasingly viewed as a long-term store of value. Its dominance over other cryptocurrencies stems from its early mover advantage and network effects, but the volatility remains. While widespread adoption could lead to greater stability, the reality is that speculation still drives much of its price action.

In this environment, your understanding of Bitcoin's dynamics is crucial. The challenges of non-stationarity, high-frequency trading, and regulatory engagement all contribute to a landscape that changes rapidly.

You need to stay informed, as Bitcoin's influence on the global financial system continues to grow. The call for action from financial institutions, like the Czech Central Bank, signals that understanding Bitcoin isn't just a matter of curiosity; it's becoming a necessity.