IRA Investing

Mastering IRA Rollover: Step-by-Step

Kickstart your IRA rollover journey with essential steps for transferring retirement funds efficiently, but there's more to unravel.

Mastering IRA rollovers step-by-step involves understanding direct transfers and indirect deposits, important for managing retirement funds effectively. Identify your IRA type, contact the administrator for necessary forms, and open a new account. Learn about direct vs. indirect rollovers to avoid tax consequences and penalties. Be mindful of tax implications and make sure timely transfers within 60 days. Complete required documentation accurately for a smooth process. Seek professional advice for guidance. Understanding these steps is essential for informed decisions and efficient fund transfers. Additional insights await as you navigate the IRA rollover journey.

Key Takeaways

- Identify your IRA type: traditional, Roth, or self-directed.

- Contact plan administrator for transfer forms.

- Open new IRA account with chosen provider.

- Ensure all necessary documentation is prepared.

- Seek professional guidance for a seamless rollover process.

Types of IRA Rollovers

When considering IRA rollovers, individuals can choose between direct transfers and indirect deposits. Direct rollovers involve transferring funds directly from one retirement account to another institution without any withholding. This method is advantageous as it avoids taxes and penalties, providing a straightforward and efficient way to move retirement funds.

On the other hand, indirect rollovers require receiving funds and then depositing them into an IRA within a strict 60-day timeframe, subject to a mandatory 20% withholding. Failing to complete the indirect rollover within the specified timeframe can result in tax consequences and penalties.

For those interested in investing in precious metals for their IRAs, Accurate Precious Metals offers facilitation of direct rollovers. This service can be particularly appealing to individuals looking to diversify their retirement portfolios with alternative assets. Understanding the distinctions between direct and indirect rollovers is essential to making informed decisions about managing retirement funds and avoiding unnecessary financial implications.

Starting Your IRA Rollover

To initiate your IRA rollover successfully, we need to understand the type of retirement account you currently have and its status, ensuring a smooth progression into the process. Start by identifying whether you have a traditional, Roth, or self-directed IRA, aligning with your financial objectives.

Contact your current plan administrator to discuss the rollover and secure the necessary forms for the transfer. Open a new IRA account with your chosen provider where you'll move your funds, ensuring you have all the required documentation in place for a seamless progression.

Seeking assistance from professionals like financial advisors can be beneficial in navigating the complexities of the IRA rollover process effectively. They can provide guidance on investment choices and help you make informed decisions regarding your retirement savings.

Direct Vs. Indirect Rollovers

Understanding the distinction between direct and indirect rollovers is vital for maximizing the efficiency of your retirement fund transfers. Direct rollovers involve transferring funds directly from one retirement account to another without facing tax consequences.

On the other hand, indirect rollovers require you to receive funds and deposit them into an IRA within 60 days to avoid penalties. Opting for direct rollovers is more effective as they bypass the potential 20% withholding that may apply to indirect rollovers.

It's important to grasp these differences to make informed decisions about your retirement savings. Accurate Precious Metals specializes in facilitating direct rollovers, especially for clients looking to invest in precious metals.

Tax Implications and Timing

Managing the tax implications and timing of IRA rollovers demands careful consideration and adherence to specific guidelines to guarantee a seamless transfer of funds. When deciding between direct and indirect rollovers, understanding the potential 20% withholding for indirect rollovers is critical. Direct rollovers emerge as the preferred choice, sidestepping complexities and potential tax consequences, ensuring a tax-free transfer. The timing of rollovers is equally paramount; funds must be deposited within 60 days to evade taxes and penalties. To prevent taxation on indirect rollovers, it's imperative to deposit the full distribution amount into the new IRA promptly. Accurate reporting plays an important role in this process.

| Keywords | Definition | Importance |

|---|---|---|

| Tax Implications | Potential tax consequences resulting from IRA rollovers. | Essential for financial planning |

| Timing | The critical period within which funds must be deposited to avoid penalties. | Critical for seamless transactions |

| Deposit | The act of placing funds into the new IRA account. | Ensures tax-free transfers |

Completing the Rollover Process

As we move into finalizing the rollover process, a thorough understanding of the required documentation is vital for a smooth transfer of funds.

Completing the rollover within the 60-day limit is essential to avoid penalties associated with indirect rollovers.

Accurate completion of rollover forms is pivotal to facilitating the process efficiently.

When deciding between direct and indirect rollovers, consider your timeline and the tax implications involved.

Seeking professional guidance from experts like Accurate Precious Metals can help navigate the IRA rollover process effectively.

It's imperative to maintain clear records of the transaction for IRS reporting and tax purposes.

By staying organized and following the necessary steps, you can guarantee a successful rollover.

Remember that attention to detail and adherence to guidelines will help you shift smoothly, especially when moving to a new job.

Frequently Asked Questions

Can I Manage My Own Rollover Ira?

Yes, we can manage our own rollover IRA. It grants control over our retirement funds and investment choices. We decide how to grow our savings, benefiting from flexibility and potential returns. Conduct research and seek guidance for success.

How to Do an IRA Rollover?

We effortlessly execute an IRA rollover by transferring retirement savings to an Individual Retirement Account, ensuring tax-deferred benefits and access to diverse investments. Utilizing direct rollovers maintains simplicity and tax efficiency, avoiding risks.

What Is the 12 Month Rule for IRA Rollover?

We must remember the 12 Month Rule for IRA Rollover, restricting us to one rollover per 12-month period. Violating this rule can lead to taxes, penalties, and disqualification of the rollover. Understanding and following this rule is essential.

How Should an IRA Rollover Check Be Made Out?

We should make an IRA rollover check payable to the new custodian where the IRA will be held. Correct spelling and details are essential to avoid delays. Paying the individual can lead to tax issues. Proper completion guarantees a smooth transfer.

Conclusion

To sum up, mastering the IRA rollover process is essential for securing a comfortable retirement. By understanding the different types of rollovers, knowing how to start the process, and being aware of tax implications, you can navigate this financial decision with confidence.

Remember, timing is key, so make sure to complete the rollover efficiently to maximize your retirement savings. With the right knowledge and steps in place, you can take control of your financial future and retire with peace of mind.

Lawrence founded The Liberty Portfolio to make complex retirement planning accessible to everyone. With extensive experience in investment strategies and financial planning, he leads our strategic direction and ensures that our offerings are aligned with the latest economic trends and regulations. Lawrence’s deep understanding of market dynamics and investment opportunities shapes our platform’s foundational content and tools.

IRA Investing

Self-Directed IRA Private Placement Investing Guide

Discover how Private Placement Investing with a Self-Directed IRA can diversify your portfolio. Your ultimate guide to savvy retirement planning.

Did you know that private placement investing is a powerful strategy for retirement planning? With the ability to potentially achieve higher returns and diversify your portfolio, private placements offer an alternative investment option for self-directed Individual Retirement Accounts (IRAs).

By establishing a self-directed IRA, you can gain access to a wider range of investment opportunities, including private equity investments. This guide will provide valuable insights into investing in private placements with a self-directed IRA, exploring the types of investments available, the rules and considerations involved, and the steps to get started.

Key Takeaways:

- Private placement investing can be a powerful strategy for retirement planning with a self-directed IRA.

- Self-directed IRAs offer access to a wider range of investment options, including private equity investments.

- Investing in private placements requires understanding the rules, conducting due diligence, and seeking professional advice.

- By carefully considering your investment objectives and risk tolerance, you can optimize your retirement planning strategy.

- Choosing a reliable custodian is crucial for effectively managing your self-directed IRA.

Investing in Private Placement with a Self-Directed IRA

Investing in private placement with a self-directed IRA provides individuals with a unique avenue for pursuing alternative investments. In a recent webinar hosted by The Entrust Group, they shed light on the numerous benefits and detailed the process of utilizing self-directed IRAs in private placement investing. The webinar covered an array of topics, including the various types of self-directed accounts available, investment options, due diligence best practices, and the step-by-step process of investing in private placement using a self-directed IRA.

“Investing in private placement with a self-directed IRA allows individuals to diversify their portfolios and discover unique investment opportunities.”

Private placement investing with a self-directed IRA grants access to a wide range of alternative investment options, such as privately-held companies, hedge funds, limited partnerships, and real estate investment trusts (REITs). These investments offer individuals the freedom to explore different avenues for potential growth outside of traditional investment options.

By leveraging a self-directed IRA, individuals can exercise greater control over their retirement funds and explore alternative investment possibilities that align with their financial goals and risk tolerance. With a self-directed IRA, investors have the freedom to select and direct the investments, allowing for a personalized investment strategy.

Types of Alternative Investments

When investing in private placement with a self-directed IRA, individuals have a multitude of alternative investment options to choose from. These include:

| Alternative Investments | Description |

|---|---|

| Private Equity | Investing in privately owned businesses or funds |

| Real Estate | Investing in rental properties, commercial properties, or REITs |

| Private Debt | Investing in privately issued loans or debt securities |

| Private Placements | Investing in companies that are not publicly traded |

| Startups | Investing in early-stage companies |

These alternative investment options offer the potential for higher returns, diversification, and exposure to different sectors of the market.

Utilizing a self-directed IRA for private placement investing enables individuals to tap into a diverse range of opportunities outside the traditional stock and bond markets. However, it is crucial to conduct thorough due diligence and engage in careful research when selecting these alternative investment options. This ensures investors are making well-informed decisions that align with their financial objectives.

Next, we will explore the specific rules and considerations associated with private placements and self-directed IRAs, shedding light on the intricacies of this investment strategy.

Private Equity Investments with Self-Directed IRAs

Private equity investments with self-directed IRAs offer account holders the opportunity to focus on privately owned assets in businesses. With a self-directed IRA, individuals have control over their investment portfolio and can choose to invest directly in a company or through a pooled investment vehicle or fund.

This investment strategy provides several benefits. First, it offers control and flexibility, allowing investors to actively manage their portfolio and make investment decisions based on their own research and assessment. This level of control ensures that the investment aligns with their long-term retirement saving goals.

Additionally, private equity investments with self-directed IRAs offer access to a wider range of investment opportunities, including alternative investments not typically available in traditional retirement accounts. This diversification can potentially lead to higher returns and reduced risk through exposure to different asset classes.

“Private equity investments with self-directed IRAs offer control, flexibility, diversification, and potential for higher returns.”

Furthermore, private equity investments with self-directed IRAs provide tax advantages. As the investments are made through the IRA, any gains or income generated from these investments can be tax deferred or tax-free, depending on the type of account.

Overall, private equity investments with self-directed IRAs can be an attractive option for investors looking to take a more active role in their retirement planning. By leveraging their investment control and exploring a broader range of investment opportunities, individuals can potentially enhance their portfolio performance and work towards their long-term financial goals.

Benefits of Private Equity Investments with Self-Directed IRAs:

- Control and flexibility over investment choices

- Diversification within the portfolio

- Access to alternative investments

- Potential for higher returns

- Tax advantages

- Alignment with long-term retirement saving goals

Rules and Considerations for Private Placements with SDIRAs

When investing in private placements with self-directed IRAs, it is important to understand the rules and considerations in order to make informed decisions. Compliance with SEC requirements, conducting due diligence, and adhering to certain restrictions are crucial aspects of the investment process.

SEC Requirements for Private Placements

Private placements are exempt from registration and reporting requirements imposed by the Securities and Exchange Commission (SEC). However, it is important to note that investors must meet the accreditation criteria established by the SEC. This means that individuals must have a certain level of income or assets to qualify for private placements.

Due Diligence

Due diligence plays a vital role in mitigating risks associated with private placements. Investors should thoroughly research potential investments, review offering documents, and seek professional advice when necessary. This comprehensive analysis helps identify potential red flags, evaluate the investment’s viability, and assess the risks involved.

Restrictions and Considerations

Investing in private placements with self-directed IRAs also involves a set of restrictions and considerations. Some of these include:

- Restrictions on purchasing private stock already owned: It is important to note that self-directed IRAs cannot purchase private stock that the account holder already owns outside of the IRA. This ensures compliance with IRS regulations.

- Limitations on employment with the company: Investing in a private placement cannot involve employment with the company where the funds are being invested. This limits potential conflicts of interest and ensures impartial investment decision-making.

- Ownership of equity and payment of fees and costs: The self-directed IRA owns the equity in the investment, and all expenses related to the investment, such as fees and costs, are paid by the IRA.

By following these rules and considerations, investors can navigate the complexities of private placements with self-directed IRAs effectively.

| Rules and Considerations | Description |

|---|---|

| SEC Requirements | Investors must meet accreditation criteria imposed by the SEC to participate in private placements. |

| Due Diligence | Conduct comprehensive research and assessment of investment opportunities to minimize risks. |

| Restrictions on purchasing private stock already owned | Self-directed IRAs cannot buy private stock already owned outside of the IRA. |

| Limitations on employment with the company | Investors cannot be employed by the company in which the funds are being invested. |

| Ownership of equity and payment of fees and costs | The self-directed IRA owns the equity and pays for investment-related expenses. |

Types of Private Equity Investments with SDIRAs

Private equity investments with self-directed IRAs provide investors with a wide range of options to diversify their portfolios and potentially achieve higher returns. These investments offer the opportunity to invest in various asset classes, including:

- Private Stock: Investing in privately held companies allows SDIRA holders to participate in the growth and success of these businesses.

- Hedge Funds: Privately held hedge funds offer sophisticated investment strategies and potential for higher returns.

- Limited Partnerships: SDIRA owners can invest in limited partnerships to gain exposure to different industries and share in the profits.

- Limited Liability Companies (LLCs): Investing in LLCs through SDIRAs provides flexibility and control over the investment.

- Real Estate Investment Trusts (REITs): REITs allow investors to participate in the real estate market without directly owning properties.

Aside from these commonly known private equity investments, there are also other avenues for SDIRA holders to explore:

- Small businesses

- Startups

- Partnerships

- Corporations

- Equity crowdfunding

- Convertible notes

- Franchises

- Land trusts

By diversifying their SDIRA portfolios with these private equity investments, investors can strategically allocate their retirement funds, aiming for long-term growth and potentially higher returns.

Advantages of Different Private Equity Investments

Each type of private equity investment with SDIRAs offers unique advantages:

| Type of Investment | Advantages |

|---|---|

| Private Stock | Opportunity to invest in private companies and potentially benefit from their growth and success |

| Hedge Funds | Potentially higher returns and access to sophisticated investment strategies |

| Limited Partnerships | Opportunity to invest in different industries and share in the profits |

| Limited Liability Companies (LLCs) | Control and flexibility over investment decisions |

| Real Estate Investment Trusts (REITs) | Participation in the real estate market without direct property ownership |

Investors should carefully evaluate each type of private equity investment, considering their risk tolerance, investment goals, and long-term retirement planning strategy. Consulting with financial advisors and conducting thorough due diligence is essential to make informed investment decisions.

Benefits of Private Equity Investments with SDIRAs

Private equity investments with self-directed IRAs offer a range of advantages for savvy investors seeking to diversify their portfolios and achieve long-term financial goals. Let’s explore the key benefits of private equity investments with SDIRAs:

- Control and Flexibility: With self-directed IRAs, investors have full control over their investment choices, allowing them to actively participate in decision-making processes. This level of control empowers individuals to tailor their investment strategy according to their risk tolerance, financial objectives, and personal circumstances.

- Diversification: Private equity investments present an opportunity to diversify one’s investment portfolio beyond traditional asset classes like stocks and bonds. By allocating funds to private equity investments, investors can spread their risk across different sectors, industries, and strategies, helping to mitigate potential losses and increase the potential for gaining attractive returns.

- Access to Alternative Investments: Self-directed IRAs provide access to a wide range of alternative investments, such as venture capital, private equity funds, real estate partnerships, and more. These alternative investments often have the potential for higher returns compared to conventional investment options, offering investors the chance to tap into unique opportunities and potentially enhance their overall portfolio performance.

- Potential for Higher Returns: Private equity investments have historically delivered strong returns compared to traditional investments. By investing in privately owned businesses or funds, individuals may benefit from the growth and success of these ventures, potentially generating significant capital appreciation and income over the long term.

- Tax Advantages: Private equity investments made through self-directed IRAs can provide tax advantages. Depending on the structure of the investment and specific tax regulations, investors may enjoy benefits such as tax deferral, tax-free growth, and potential tax deductions, ultimately optimizing their investment returns and minimizing tax liabilities.

- Long-Term Investment Focus: Private equity investments are typically seen as long-term commitments. This aligns well with the goal of retirement planning, as individuals can take advantage of the compounding effect over an extended period. By choosing carefully structured private equity investments, investors can optimize their retirement savings and work towards achieving their long-term financial objectives.

To illustrate the benefits of private equity investments with SDIRAs further, let’s take a look at the following example:

“Investing in private equity through a self-directed IRA allowed John to diversify his retirement portfolio with investments in startup companies, real estate partnerships, and private equity funds. This enabled him to participate in exciting ventures and potentially generate higher returns compared to traditional investments. Furthermore, John appreciated the control and flexibility he had over his investment decisions, allowing him to align his investment strategy with his risk tolerance and long-term financial goals.”

Steps for Investing in Private Placement with a SDIRA

Investing in private placement with a self-directed IRA involves several steps. By following these steps, you can make informed decisions and optimize your investment strategy.

Create a Self-Directed IRA with a Reliable Custodian

The first step is to establish a self-directed IRA with a trustworthy custodian. Choose a custodian that specializes in self-directed IRAs and has experience in private placement investments. A reliable custodian will provide the necessary guidance and support throughout the investment process.

Roll Over Funds from Retirement Plans or Transfer Funds from an Existing IRA

Once you have a self-directed IRA, you can transfer funds from an existing IRA or roll over funds from retirement plans such as 401(k)s or 403(b)s. This step allows you to consolidate your retirement savings and have the funds available for private placement investments.

Instruct Your Self-Directed IRA Custodian to Invest

After funding your self-directed IRA, the next step is to instruct your custodian to invest in your preferred private equity investment. Provide the necessary information and instructions to your custodian, who will then facilitate the investment on behalf of your IRA.

Following these steps ensures that you have a well-established self-directed IRA and have taken the necessary actions to invest in private placement opportunities. By working with a reliable custodian, consolidating your funds, and providing instructions, you can navigate the process smoothly and make sound investment decisions for your retirement.

Considerations Before Investing in Private Placement with a SDIRA

Before embarking on private placement investing with a self-directed IRA (SDIRA), it is essential to consider a few crucial factors to make informed investment decisions. These considerations will help align your investment objectives and risk tolerance with the opportunities presented by private placements.

1. Identify Investment Objectives

Begin by clearly defining your investment objectives. Are you seeking long-term growth, income generation, or a combination of both? Understanding your objectives will help you evaluate private placement opportunities that align with your desired investment outcomes.

2. Assess Risk Tolerance

It is equally vital to assess your risk tolerance before investing in private placements with an SDIRA. Private placement investments can carry higher risks compared to traditional investment options. Evaluate your comfort level with market volatility, illiquidity, and the potential for loss.

3. Conduct Thorough Due Diligence

Prioritize conducting thorough due diligence on potential private placement opportunities. Research the issuer’s track record, financials, industry trends, and competitive landscape. Evaluate the investment’s viability, potential returns, and associated risks.

“Due diligence is the foundation of successful private placement investing. Take the time to conduct extensive research and analysis to uncover the potential and risks of each investment opportunity.”

4. Seek Professional Advice

Consider seeking advice from financial, tax, and legal professionals who specialize in SDIRA investments. They can provide valuable insights and help navigate the complex regulations and tax implications associated with private placements. Their expertise can ensure you make well-informed decisions aligned with your financial goals.

5. Choose an Experienced Custodian

Selecting the right custodian for your SDIRA is crucial. An experienced custodian can offer guidance, assistance in managing your assets, and ensure compliance with IRS regulations. Choose a custodian with a strong track record of facilitating private placement investments to benefit from their expertise and support.

By carefully considering your investment objectives, conducting thorough due diligence, seeking professional advice, and choosing an experienced custodian, you can confidently navigate the world of private placement investing with an SDIRA. Making informed decisions will help you maximize potential returns while managing risks effectively.

| Benefits of Considerations | Private Placement with SDIRA |

|---|---|

| Alignment with Investment Objectives | ✔️ |

| Mitigation of Risks | ✔️ |

| Confident Decision-Making | ✔️ |

| Compliance with Regulations | ✔️ |

Conclusion

Private placement investing with a self-directed IRA offers individuals the opportunity to diversify their portfolios and potentially achieve higher returns. By understanding the rules surrounding private placements with SDIRAs and considering different types of private equity investments, investors can make informed decisions and optimize their retirement planning strategy.

Successful private placement investing requires diligent research and due diligence on potential investment opportunities. Seeking professional advice from financial, tax, and legal experts can provide valuable insights and guidance in navigating this complex investment landscape.

Furthermore, selecting a reliable and experienced custodian to manage self-directed IRAs is crucial to ensure compliance and transparency throughout the investment process. With careful planning and consideration, individuals can leverage the power of private placement investing to enhance their retirement planning goals and secure their financial future.

FAQ

How do I invest in private placement with a self-directed IRA?

What are the benefits of private equity investments with self-directed IRAs?

What are the rules and considerations for private placements with self-directed IRAs?

What are the types of private equity investments that can be made with self-directed IRAs?

What are the steps for investing in private placement with a self-directed IRA?

What considerations should I keep in mind before investing in private placement with a self-directed IRA?

Lawrence founded The Liberty Portfolio to make complex retirement planning accessible to everyone. With extensive experience in investment strategies and financial planning, he leads our strategic direction and ensures that our offerings are aligned with the latest economic trends and regulations. Lawrence’s deep understanding of market dynamics and investment opportunities shapes our platform’s foundational content and tools.

IRA Investing

Why Does Diversification Matter?

Justify the importance of diversification for a stable financial future and discover how it can protect your investments effectively.

Diversification matters because it lowers risk by spreading investments across different assets like stocks, bonds, and real estate, reducing the impact of market swings. Mixing asset classes helps balance losses in specific sectors, protecting against downturns. Including international stocks adds a layer of global opportunity, enhancing diversification. Strategies like diversifying by geography and industry manage risk effectively. Mutual funds or ETFs offer instant diversification, and guidance from a Financial Advisor tailors plans. By diversifying, your portfolio can be more stable, giving you a better chance at long-term financial growth. More insights await for those seeking to secure their financial future.

Key Takeaways

- Reduces portfolio risk by including various asset classes.

- Mitigates market volatility by diversifying investments.

- Protects against industry-specific downturns.

- Enhances wealth preservation and growth over time.

- Provides stability, higher returns, and risk management in financial planning.

Importance of Asset Class Diversification

Asset class diversification plays a key role in reducing overall portfolio risk by spreading investments across various types of assets. By including a mix of stocks, bonds, real estate, and commodities in our investment portfolio, we can better navigate the unpredictable nature of the market.

Historical data clearly demonstrates that different asset classes perform diversely in various market conditions. This means that when one asset class underperforms, others may thrive, balancing out the overall returns of the portfolio. Market volatility, a common occurrence, can have a significant impact on investment returns. However, through diversification across asset classes, we can mitigate this risk and achieve a more stable long-term performance.

Including international stocks in our asset allocation is important as it provides exposure to non-US opportunities and further diversifies our risk. Therefore, a well-diversified portfolio not only helps in managing risk but also sets the stage for potentially higher returns over time.

Risk Reduction Through Diversification

By spreading our investments across different assets, we effectively reduce risk through diversification. Diversification helps in minimizing the impact of negative events in specific industries or companies, ultimately reducing portfolio volatility.

Through proper asset allocation and diversifying into different investments, investors can potentially lower their overall risk exposure. Studies have shown that diversification leads to more stable and consistent returns over time, making it an essential strategy for those aiming for stable growth.

Additionally, diversification can protect against significant losses during market downturns, acting as a shield for our investments. By ensuring a well-diversified portfolio, we can better navigate the unpredictable nature of the market and safeguard our financial future.

It's key to understand that diversification isn't just a strategy but a powerful tool to secure and enhance our wealth over the long term.

Tailoring Portfolios to Manage Risk

Spreading investments across various asset classes, industries, and regions is a fundamental approach in tailoring portfolios to manage risk effectively. When customizing portfolios to mitigate risk, several key strategies should be considered:

- Asset Allocation: Balancing investments between stocks and bonds can help cushion the impact of market fluctuations.

- Geographic Diversification: Investing in different regions can reduce the impact of localized economic downturns.

- Industry Diversification: Spreading investments across various industries can lessen the risk associated with sector-specific challenges.

Benefits of Diversifying Investments

Diversification in investments offers a range of benefits that can enhance overall portfolio performance. By spreading investments across different asset classes, investors can reduce risk and potentially achieve higher risk-adjusted returns. This strategy not only leads to smoother investment performance over time but also helps mitigate the impact of market downturns on the financial portfolio. Moreover, diversification encourages investors to conduct thorough research and gain a deeper understanding of various industries and regions. This approach provides a sense of security and stability, making the investing journey more enjoyable.

| Benefits of Diversifying Investments | ||

|---|---|---|

| Financial Stability | Mitigation of Market Downturns | Higher Risk-Adjusted Returns |

| Spreading investments reduces risk | Helps protect against market fluctuations | Potential for increased returns |

Strategies for Effective Diversification

Exploring various strategies for effective diversification is essential for optimizing investment portfolios and minimizing risk exposure. To achieve this, consider the following key tactics:

- Asset Allocation: Diversifying across various asset classes such as stocks, bonds, and real estate can help spread risk and enhance portfolio stability.

- Geographic Diversification: Investing in different regions or countries can reduce the impact of local economic downturns or geopolitical events on your portfolio.

- Utilizing Mutual Funds or Exchange-Traded Funds: These investment vehicles can offer instant diversification by pooling money from multiple investors to invest in a diversified portfolio of assets.

When developing a diversified investment strategy, it's vital to also consider factors like company size diversification, industry diversification, and adjusting asset allocation based on your target retirement date.

Seeking advice from a Financial Advisor can further aid in creating a personalized diversification plan aligned with your financial goals.

Impact of Diversification on Returns

When it comes to investing, the impact of diversification on returns can't be overstated.

By spreading our investments across various asset classes, we aim to enhance our return potential while reducing overall portfolio risk.

This strategy not only offers the benefits of improved stability but also helps us optimize our investment performance over the long term.

Enhanced Return Potential

Enhancing return potential through diversification involves strategically allocating investments across various asset classes to optimize risk-adjusted performance. Diversifying your portfolio can lead to higher risk-adjusted returns, capturing gains from different sectors while minimizing losses. Studies suggest that by spreading investments, you can reduce overall portfolio risk and enhance performance over time.

- Diversification enables the optimization of returns by minimizing the impact of market volatility.

- Allocating funds across different assets can help in achieving more consistent returns.

- A diversified portfolio can capture gains from various market conditions, enhancing overall performance.

Risk Reduction Benefits

By diversifying investments, we can effectively reduce risk and enhance returns by mitigating portfolio volatility. When we spread our investments across different assets, such as stocks, bonds, and real estate, we reduce the overall risk in our portfolio.

Diversification allows us to divvy up our investments among various sectors and regions, helping to reduce the volatility caused by market fluctuations. By diversifying among different assets, we can mitigate the risk of large losses due to unforeseen events impacting a single investment. This strategy is particularly effective in reducing unsystematic risk, which can make up a significant portion of a portfolio's volatility.

Research shows that proper diversification can lead to smoother investment journeys and potentially higher risk-adjusted returns over the long term.

Portfolio Stability Advantages

Diversification plays a crucial role in enhancing portfolio stability and potentially boosting returns through effective risk management. When contemplating the advantages of portfolio stability in diversified portfolios, it's crucial to understand the impact on returns. Here are three key aspects to contemplate:

- Reducing Portfolio Volatility: Spreading investments across different asset classes can help lower overall portfolio volatility.

- Balancing Risk: By diversifying, investors can better manage the impact of market downturns and reduce the potential for significant losses.

- Stable Returns: Studies have shown that diversified portfolios tend to provide more stable returns over time compared to concentrated investments, leading to a smoother investment journey.

Diversifying for Long-Term Stability

How can spreading investments across different asset classes contribute to long-term stability? Diversifying our portfolio with a mix of assets like bonds, stocks, and real estate investment trusts (REITs) can help in achieving long-term stability. By having exposure to various types of investments, we can reduce the impact of market fluctuations and potential losses in any single asset class. This table illustrates how different assets can play a role in enhancing long-term stability:

| Asset Class | Role in Long-Term Stability |

|---|---|

| Bonds | Provide steady income and stability |

| Stocks | Offer growth potential and higher returns |

| Real Estate Investment Trusts | Diversify into real estate without direct ownership |

Balancing these assets effectively can help in wealth preservation and smooth out the effects of interest rate changes or market volatility. Studies have shown that a diversified portfolio tends to provide more consistent performance over extended periods, making it an essential strategy for investors focused on sustained growth and stability.

Avoiding Pitfalls of Undiversified Portfolios

Undiversified portfolios can be risky due to their vulnerability to significant losses if a single asset class or investment performs poorly. This lack of diversification increases the chances of losing all funds during market downturns or industry-specific crises.

Risk of Concentration

Concentration in a few assets or industries poses a significant risk for undiversified portfolios. When a portfolio is overly concentrated, it becomes vulnerable to specific asset or sector-specific risks, potentially leading to substantial losses. To mitigate this risk, diversifying across different assets and industries is important.

- Reduced Impact of Market Fluctuations: Diversification helps cushion the impact of market fluctuations on the overall portfolio performance.

- Mitigation of Individual Stock Risk: By spreading investments across various stocks, the risk associated with individual stocks is minimized.

- Protection Against Economic Downturns: Diversified portfolios are better positioned to weather economic downturns compared to concentrated portfolios.

Benefits of Spread

By spreading investments across different assets, diversification helps investors avoid the pitfalls associated with undiversified portfolios. It is essential to manage risk and reduce the impact of market fluctuations. Diversifying across specific types of assets can guarantee a more stable overall return. Past performance has shown that overexposure to a single stock or sector can lead to significant losses. By diversifying, investors can better manage market risk and achieve a more balanced investment portfolio. Here is a table summarizing the benefits of spreading investments:

| Benefits of Spread | |

|---|---|

| Reduces Risk of Losses | Diversification helps avoid significant losses from downturns |

| Enhances Overall Performance | Provides a more stable and consistent performance over time |

| Protects Against Fluctuations | Avoids overexposure to a single stock or sector's unexpected changes |

Role of Diversification in Financial Planning

In our financial planning, diversification emerges as a pivotal strategy, spreading investment risk across various asset classes. When considering the role of diversification in financial planning, we must understand its significance in achieving our goals effectively. Here are three key points to highlight its importance:

- Minimizing Market Volatility: Diversification helps in reducing the impact of market volatility on our investment portfolio. By spreading our investments across different types of assets, we can cushion the effects of sudden market fluctuations.

- Protecting Against Market Downturns: During market downturns, a well-diversified portfolio is less likely to experience significant losses compared to a concentrated one. This protection can safeguard our financial future and prevent setbacks in achieving our long-term objectives.

- Enhancing Risk-Adjusted Returns: Through diversification, we can optimize our risk-adjusted returns over time. By balancing our investments across various asset classes, we aim to achieve stable growth while managing the level of risk we're exposed to.

Maximizing Diversification Across Investments

When aiming to maximize diversification across investments, we should focus on achieving a balanced asset class mix to reduce overall risk.

By spreading our investments across various sectors and regions, we can minimize the impact of industry-specific challenges.

This strategy helps us enhance our risk-adjusted returns and navigate potential market fluctuations more effectively.

Asset Class Mix

Maximizing diversification across investments involves strategically allocating funds across various asset classes to mitigate overall portfolio risk. When considering asset class mix, prioritizing effective diversification is crucial to optimize investment performance and enhance portfolio stability.

To achieve this, consider the following:

- Balancing Act: Allocate funds across different asset classes like Fixed Income, Stock Market, and Real Estate to spread risk and maximize returns.

- Economic Resilience: Each asset class reacts differently to economic conditions, providing a cushion against market turbulence.

- Risk Mitigation: A well-diversified asset class mix can protect against specific market risks and enhance overall portfolio stability.

Risk Reduction

Diversification across investments enhances portfolio stability by reducing overall risk exposure through strategic allocation of funds across various asset classes. When considering risk reduction, estate investment trusts (REITs), Aggregate Bond, MSCI EAFE, and high-yield bonds play important roles.

Indexes are unmanaged but highly correlated with one another, impacting bond prices and fixed-income investments. By including these diverse assets in a portfolio, investors can benefit from a risk-reducing effect that shields against significant losses during market fluctuations.

Maximizing diversification is key to achieving a balanced risk-return profile, ensuring that the portfolio remains resilient in the face of changing market conditions. Through thoughtful allocation and broad diversification, investors can enhance their chances of long-term financial success.

Frequently Asked Questions

Why Is Diversification so Important?

Diversification is essential for our success. It reduces risk substantially, helping us ride out market turbulence and achieve better returns. It's not just important; it's vital for reaching our financial goals and securing our future.

What Is the Power of Diversification?

Diversification harnesses a force like no other, shielding us from market storms and amplifying our returns. It's the secret weapon in our arsenal, revealing the power to conquer volatility and steer towards success.

How Effective Is Diversification?

Diversification is highly effective. It spreads risk, boosts returns, and reduces market volatility impact. Historical data proves diversified portfolios have smoother returns during fluctuations. We minimize losses and increase gains through proper diversification.

Why Is Diversification Important in Mutual Funds?

Diversification in mutual funds is crucial for reducing risk. By spreading investments across various assets, we can manage volatility better. This approach helps maintain a balanced risk-return profile, safeguarding our portfolio against individual stock fluctuations.

How Can Diversification Protect Against Lawsuits Involving Regal Assets?

Diversification with regal assets lawsuit insights can protect your investment portfolio from lawsuits. By spreading your assets across different industries and types of investments, you can minimize the impact of potential legal issues involving Regal Assets. This strategy can help safeguard your overall financial stability and protect against significant losses.

Conclusion

To sum up, diversification is like planting a garden with a variety of crops – it helps protect against the risk of a single crop failing.

By spreading investments across different asset classes, you can reduce risk and increase the likelihood of long-term stability in your portfolio.

Remember, diversification is key to weathering the ups and downs of the market and achieving your financial goals for retirement.

Lawrence founded The Liberty Portfolio to make complex retirement planning accessible to everyone. With extensive experience in investment strategies and financial planning, he leads our strategic direction and ensures that our offerings are aligned with the latest economic trends and regulations. Lawrence’s deep understanding of market dynamics and investment opportunities shapes our platform’s foundational content and tools.

IRA Investing

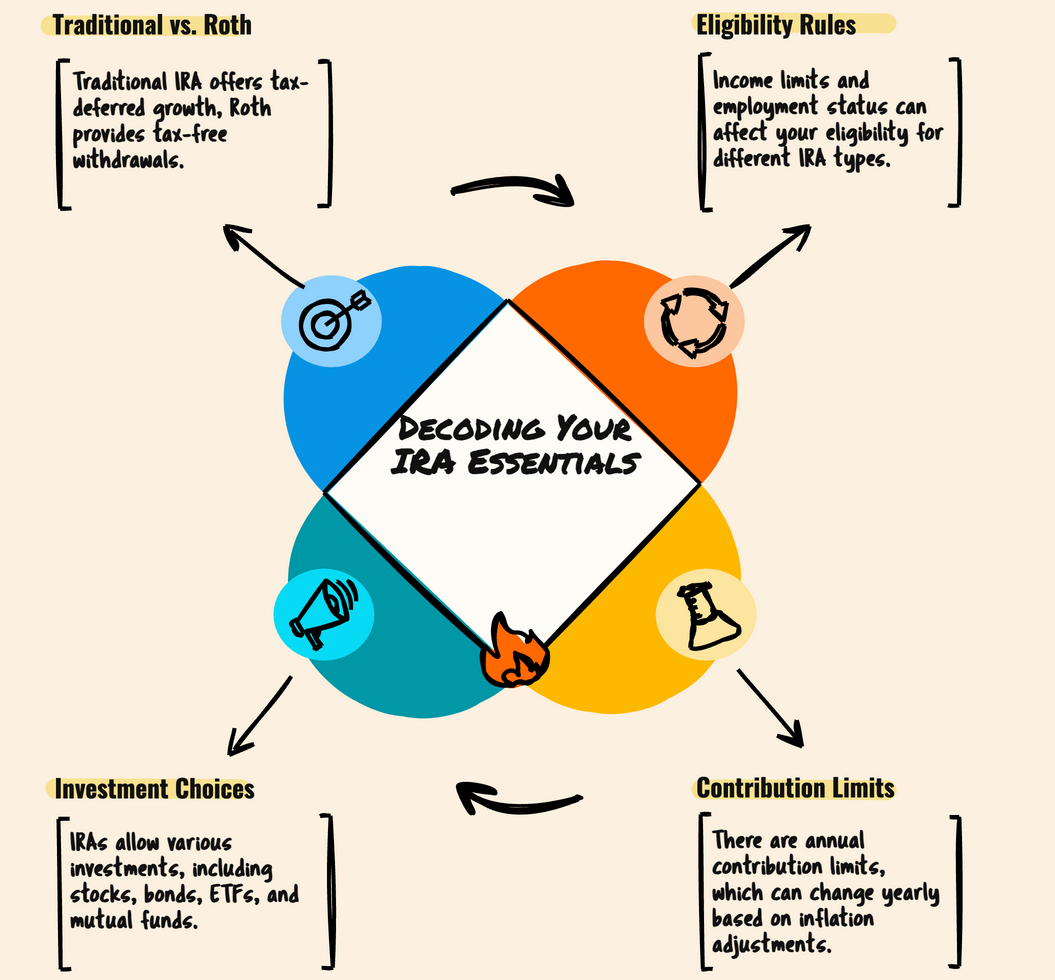

Understanding Your Individual Retirement Account (IRA): Types, Investments, and How It Works

Did you know that only 55% of Americans have access to a workplace retirement plan?

With the decline of traditional pension plans and uncertainty surrounding Social Security, it’s essential to explore different IRA investment types for retirement planning. These investment options provide tax advantages and the opportunity to grow your savings over time.

Key Takeaways:

- Traditional IRAs offer tax-deductible contributions and tax-deferred earnings until retirement.

- Roth IRAs provide tax-free withdrawals in retirement but require after-tax contributions.

- SEP IRAs are ideal for self-employed individuals and small business owners.

- Self-directed IRAs allow for investing in a wide range of assets beyond traditional stocks and bonds.

- Individual 401(k)s offer higher contribution limits for self-employed individuals and business owners.

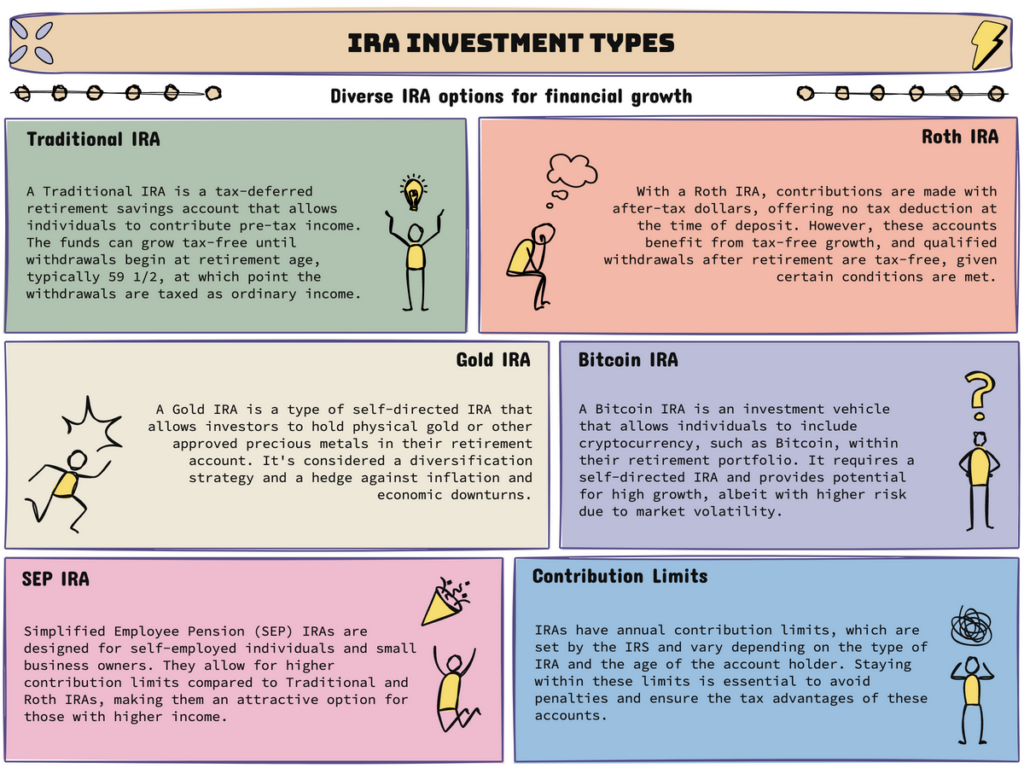

Understanding Traditional IRAs

Traditional IRAs are among the most common retirement accounts available. They provide individuals with a tax-advantaged way to save for retirement. With a traditional IRA, individuals can set up an account at a financial institution and contribute money to be invested in their future.

One of the main benefits of a traditional IRA is the potential for tax deductions. Contributions to a traditional IRA may be tax-deductible, meaning they can lower an individual’s taxable income for the year. This can lead to potential tax savings, especially for those in higher tax brackets.

Another advantage of a traditional IRA is the tax-deferred growth of earnings. Any interest, dividends, or capital gains earned within the account are not subject to taxes until withdrawals are made in retirement. This allows the investments in the IRA to grow and compound over time without the drag of annual taxes.

It’s important to note that contributions to a traditional IRA are subject to annual limits set by the IRS. For the tax year 2021, the contribution limit for individuals under 50 is $6,000. Those aged 50 and older can make additional “catch-up” contributions of up to $1,000, bringing their total contribution limit to $7,000.

Contributions to a traditional IRA can be made up until the individual’s tax filing deadline, usually April 15th of the following year. However, it’s generally recommended to make contributions by the end of the calendar year to maximize the potential for tax deductions.

Tax-Deductible Contributions

Contributions made to a traditional IRA can be tax-deductible, allowing individuals to lower their taxable income. The ability to deduct contributions depends on several factors, including income level, marital status, and access to an employer-sponsored retirement plan.

Tax-Deferred Growth

Earnings within a traditional IRA grow tax-deferred, meaning they are not subject to annual taxes. This allows the investments in the account to compound over time, potentially resulting in significant growth of the retirement savings.

Year Contribution Limit Catch-Up Contributions (Age 50+) 2021 $6,000 $1,000 2020 $6,000 $1,000 2019 $6,000 $1,000

Understanding the contribution limits of a traditional IRA is important for individuals planning their retirement savings strategy. By staying within these limits, individuals can take full advantage of the tax benefits and maximize their retirement nest egg.

Overall, traditional IRAs provide a valuable retirement savings tool, offering tax advantages and the potential for long-term growth. By contributing to a traditional IRA and taking advantage of tax deductions, individuals can take important steps towards building a secure and comfortable retirement.

Exploring Roth IRAs

When planning for retirement, it’s crucial to explore the various IRA investment options available. One popular choice is the Roth IRA. Unlike traditional IRAs, Roth IRAs offer unique tax advantages that can significantly benefit your retirement savings.

Contributions to a Roth IRA are made with after-tax money, meaning you’ve already paid taxes on the funds you contribute. However, the major advantage comes during retirement when qualified withdrawals from your Roth IRA are tax-free. This tax-free status makes Roth IRAs an excellent option for individuals looking to maximize their retirement savings while minimizing future tax liabilities.

Similar to traditional IRAs, Roth IRAs have an annual contribution limit set by the IRS. For 2021, the contribution limit is $6,000 for individuals under the age of 50, with an additional catch-up contribution of $1,000 available for those aged 50 and older. By taking advantage of these contribution limits, you can steadily build your tax-free retirement nest egg.

A Roth IRA can be a valuable tool for individuals who anticipate being in a higher tax bracket during retirement or those who want to diversify their retirement savings with tax-free withdrawals. It offers flexibility and peace of mind, knowing that your hard-earned savings can grow and be withdrawn tax-free when you need it most.”Contributions to a Roth IRA are made with after-tax money, but qualified withdrawals in retirement are tax-free.

The Benefits of a Roth IRA

There are several advantages to consider when exploring Roth IRAs:

- Tax-Free Withdrawals: Qualified withdrawals from a Roth IRA in retirement are entirely tax-free, providing increased financial flexibility.

- Tax Diversification: By combining both Roth and traditional IRAs, you can create a tax-diversified retirement portfolio, allowing for strategic tax planning.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not require you to take mandatory withdrawals during your lifetime, giving you more control over your retirement savings.

It’s important to note that Roth IRAs have specific eligibility requirements based on income. For individuals with a higher income, there may be limitations or restrictions on contributing to a Roth IRA. Consulting with a financial advisor can help clarify these eligibility requirements and assist you in making informed decisions.

Considering SEP IRAs

SEP IRAs, a type of retirement savings accounts, are a popular retirement savings option for self-employed individuals and small business owners. With the ability to contribute a percentage of income, SEP IRAs offer tax-deductible contributions that can help individuals maximize their retirement savings.

Unlike traditional and Roth IRAs, SEP IRAs have higher contribution limits, making them an attractive choice for self-employed individuals with fluctuating income. The contribution limit for SEP IRAs is determined by the IRS and can vary from year to year. It’s important to stay updated on the current contribution limit to make the most of this retirement savings opportunity.

One of the key advantages of SEP IRAs is the flexibility they offer. Contributions to a SEP IRA can be made on behalf of both the business owner and eligible employees. This makes SEP IRAs not only a valuable tool for self-employed individuals but also a way for small business owners to provide retirement benefits to their employees.

It’s worth noting that SEP IRAs are subject to certain rules and regulations. For example, contributions must be made by the due date of the employer’s tax return, including extensions. Additionally, employees who meet specific eligibility requirements must receive contributions proportional to their compensation.

In conclusion, SEP IRAs offer self-employed individuals and small business owners a tax-efficient retirement savings option. With higher contribution limits and the ability to provide retirement benefits to eligible employees, SEP IRAs can play a crucial role in building a secure financial future.

Advantages of SEP IRAs Considerations for SEP IRAs

Tax-deductible contributionsHigher contribution limitsFlexibility to contribute on behalf of employeesPotential for significant retirement savings

Compliance with IRS regulationsEmployee eligibility requirementsContributions must be made by tax return due dateProportional contributions for eligible employees

Exploring Self-Directed IRAs

Self-directed IRAs offer a unique opportunity for individuals to take control of their retirement investments and explore a diverse range of investment options beyond traditional stocks and bonds. With a self-directed IRA, you have the flexibility to invest in real estate, private equity, and even cryptocurrencies, opening up a world of possibilities for growing your retirement savings.

One of the advantages of a self-directed IRA is the ability to invest in real estate. Whether you’re looking to purchase rental properties, invest in a commercial building, or even own a vacation home, a self-directed IRA allows you to use your retirement funds to make these investments. By investing in real estate through your IRA, you can potentially benefit from rental income, property appreciation, and tax advantages.

With a self-directed IRA, investors have the freedom to diversify their retirement portfolio beyond traditional investments. Real estate has long been considered a stable and profitable investment, and leveraging it through a self-directed IRA can provide significant financial benefits.

In addition to real estate, a self-directed IRA also allows you to explore investment options such as private equity. This can involve investing in private companies, startups, or even venture capital funds. By diversifying your portfolio with these alternative investment options, you can potentially access higher returns and take advantage of unique opportunities. However, it’s important to note that these investments may carry a higher level of risk and should be thoroughly researched before committing your retirement funds.

Another intriguing investment option available through a self-directed IRA is cryptocurrencies like Bitcoin. As the popularity of digital currencies continues to grow, many investors are looking to include cryptocurrencies in their retirement portfolio. Investing in cryptocurrencies through a self-directed IRA allows you to capitalize on the potential for growth and diversify your investments, all within a tax-advantaged retirement account.

It’s important to remember that while self-directed IRAs offer greater control and investment flexibility, they also come with certain responsibilities and risks. You must ensure compliance with IRS regulations and conduct thorough due diligence on any investment opportunity to protect your retirement savings.

By exploring self-directed IRAs, investors can unlock unique investment opportunities and take a proactive approach to growing their retirement savings. Whether it’s real estate, private equity, or cryptocurrencies, a self-directed IRA provides the freedom to pursue alternative investments and potentially achieve greater financial success in retirement.

Benefits of Self-Directed IRAs:

- Flexibility to invest in real estate, private equity, and cryptocurrencies

- Potential for rental income, property appreciation, and tax advantages with real estate investments

- Diversification of your retirement portfolio with alternative investment options

- Potential for higher returns and unique investment opportunities

- Control and autonomy in managing your retirement investments

Understanding Individual 401(k)s

Individual 401(k)s, also known as solo 401(k)s, are retirement plans designed specifically for self-employed individuals or business owners with no employees other than a spouse. These plans offer unique advantages and higher contribution limits compared to traditional and Roth IRAs, making them a popular choice for self-employed individuals looking to maximize their retirement savings potential.

With an individual 401(k), self-employed individuals have the opportunity to contribute both as an employer and an employee, providing them with increased flexibility and the ability to save more for retirement.

“The individual 401(k) is an excellent retirement savings vehicle for self-employed individuals. It allows them to make higher contributions compared to other retirement plans and take advantage of valuable tax benefits. It’s a powerful tool for building a secure financial future.”John Smith, Financial Advisor

Contributing to an individual 401(k) allows self-employed individuals to benefit from tax advantages similar to those of traditional 401(k) plans. Contributions made as an employer are tax-deductible, reducing taxable income. Additionally, contributions made as an employee can be made on a pre-tax or after-tax basis, depending on the individual’s preference and tax situation.

A key advantage of individual 401(k)s is the higher contribution limits they offer. As of 2021, self-employed individuals can contribute up to $58,000 or 100% of their compensation, whichever is lower. For individuals age 50 and older, an additional catch-up contribution of $6,500 is allowed, bringing the total contribution limit to $64,500.

These higher contribution limits provide self-employed individuals with the opportunity to save more for retirement compared to traditional and Roth IRAs. By maximizing their contributions to an individual 401(k), self-employed individuals can accelerate their retirement savings and potentially achieve their financial goals sooner.

Benefits of Individual 401(k)s for Self-Employed Individuals:

- Higher contribution limits compared to traditional and Roth IRAs

- Flexibility to contribute as both an employer and an employee

- Opportunity for tax-deductible contributions

- Potential for accelerated retirement savings

Self-employed individuals are encouraged to consult with a financial advisor or tax professional to determine if an individual 401(k) is the right retirement savings option for their specific needs and goals.

Retirement Plan Contribution Limits (2021) Catch-Up Contributions (Age 50+) Individual 401(k) $58,000 or 100% of compensation, whichever is lower $6,500 Traditional IRA $6,000 or $7,000 if age 50+ N/A Roth IRA $6,000 or $7,000 if age 50+ N/A

Exploring SIMPLE IRAs

When it comes to retirement plans for small businesses, the SIMPLE IRA stands out as a cost-effective and hassle-free solution. Designed for small businesses with fewer than 100 employees, a SIMPLE IRA provides employers and employees with a simplified way to save for retirement.

One of the key benefits of a SIMPLE IRA is its tax-deductible contribution feature. This means that as an employer, you can deduct your contributions to the IRA on your business taxes, helping reduce your overall tax liability.

Employees are also eligible to make contributions to their SIMPLE IRAs on a pre-tax basis, allowing them to lower their taxable income for the year. It’s a win-win situation for both employers and employees, fostering a supportive retirement savings environment.

“A SIMPLE IRA can be a game-changer for small businesses. It offers a simplified way to offer retirement benefits to employees and an opportunity for tax savings.”-Financial Advisor

However, it’s important to note that while the contribution process is simplified, there are specific contribution limits for SIMPLE IRAs. As of 2022, the maximum contribution limit for employees is $14,000, with an additional $3,000 “catch-up” contribution allowed for those aged 50 and older.

Employers, on the other hand, have two options for their contributions. They can match their employees’ contributions dollar for dollar, up to 3% of the employee’s compensation, or they can make a non-elective contribution of 2% of each eligible employee’s compensation, regardless of whether the employee contributes to the plan or not.

Benefits of SIMPLE IRAs for Small Businesses:

- Simplified administration: SIMPLE IRAs are easy to set up and maintain, reducing administrative burdens for small business owners.

- Lower costs: Compared to other retirement plans, the administrative fees associated with SIMPLE IRAs are generally lower, making them a cost-effective retirement savings account.

- Flexibility: Employees have the freedom to choose how much they want to contribute to their SIMPLE IRAs, allowing for personalized retirement savings goals.

- Tax advantages: Both employer and employee contributions to a SIMPLE IRA are tax-deductible, providing potential tax savings.

As a small business owner, offering a SIMPLE IRA can be a powerful tool in attracting and retaining talented employees. The simplicity, flexibility, and tax advantages make it an appealing retirement savings option for both employers and employees.

In the next section, we will explore another type of IRA – inherited IRAs, and the rules and considerations surrounding these accounts.

Inherited IRAs

An inherited IRA is a retirement account that is passed down to a beneficiary after the original account holder’s death. The rules governing inherited IRAs can vary depending on the relationship to the deceased and the age of the beneficiary. It’s crucial for beneficiaries to have a clear understanding of the withdrawal rules and the tax implications associated with inheriting an IRA.

When it comes to an inherited IRA, the beneficiary becomes the new account holder and has several options for handling the account. These options may include taking a lump-sum distribution, setting up an inherited IRA, or disclaiming the inheritance altogether. The choice of what to do with the inherited IRA will depend on factors such as the beneficiary’s financial situation, future plans, and overall tax strategy.

Withdrawal Rules:

One of the key aspects of an inherited IRA is understanding the withdrawal rules. The IRS requires beneficiaries to withdraw a minimum amount from the inherited IRA each year, known as the required minimum distribution (RMD). The amount of the RMD is determined by the beneficiary’s age and life expectancy, and failure to take the RMD can result in significant tax penalties.

It’s important to note that the timing of the first RMD can vary depending on the relationship between the beneficiary and the deceased account holder. Spouses who inherit an IRA from their deceased spouse have the option to treat the IRA as their own and delay taking RMDs until they reach the age of 72. Non-spouse beneficiaries, on the other hand, typically need to start taking RMDs by December 31st of the year following the original account holder’s death.

The withdrawal rules for inherited IRAs can be complex, and it’s advisable for beneficiaries to consult with a financial advisor or tax professional to ensure compliance and make informed decisions about their inherited retirement funds.

Tax Implications

Inherited IRAs have unique tax implications that beneficiaries should be aware of. While traditional IRAs are funded with pre-tax dollars and require taxes to be paid upon withdrawal, inherited IRAs have different tax treatment, emphasizing the importance of understanding the rules set by the Internal Revenue Service.

For non-spouse beneficiaries, withdrawals from an inherited IRA are generally subject to income tax. The tax rate is based on the beneficiary’s individual tax bracket, and it’s essential to plan for the potential tax liability. Additionally, inherited IRAs do not have the same penalty-free withdrawal exceptions as traditional and Roth IRAs, so beneficiaries should carefully consider their financial needs before making withdrawals.

It’s worth noting that Roth IRAs that are inherited have slightly different tax implications. Since Roth IRAs are funded with after-tax dollars, qualified distributions from an inherited Roth IRA are generally tax-free. However, non-qualified distributions may be subject to income tax and penalties.

Ultimately, understanding the tax implications of an inherited IRA is critical for beneficiaries to effectively manage their retirement assets and maximize their savings.

“Inherited IRAs can provide a valuable source of retirement income for beneficiaries. However, it’s important to carefully navigate the withdrawal rules and tax implications to avoid unnecessary penalties and tax liabilities. Seek professional guidance to make informed decisions.”

To illustrate the potential tax implications of an inherited IRA, here is a table comparing the tax treatment for traditional IRAs and Roth IRAs:

IRA Type Tax Treatment for Beneficiaries Traditional IRA Taxed as ordinary income upon withdrawal Roth IRA Qualified distributions are tax-free; non-qualified distributions may be subject to income tax and penalties

Understanding the rules and implications associated with inherited IRAs is crucial for beneficiaries who are tasked with managing these retirement accounts. By navigating withdrawal rules and considering tax implications, beneficiaries can make informed decisions about their inherited IRA and effectively plan for their own future retirement.

Exploring Health Savings Accounts (HSAs)

While not technically an IRA, Health Savings Accounts (HSAs) offer individuals a tax-advantaged solution to save for medical expenses. With rising healthcare costs, having a dedicated account for medical needs is crucial for financial planning. HSAs provide individuals with a triple tax advantage, making them a valuable tool for healthcare savings.

Contributions to an HSA are tax-deductible, which means that individuals can lower their taxable income by depositing funds into their account. This tax advantage allows for additional savings and potentially lower tax liabilities. It’s a win-win situation.

“Contributions to an HSA are tax-deductible, which means that individuals can lower their taxable income by depositing funds into their account.”

HSAs also offer tax-free withdrawals for qualified medical expenses. This means that individuals can use the funds in their HSA to pay for medical costs without incurring any additional tax burden. It’s an efficient and convenient way to handle medical expenses.

It’s important to note that HSAs can be used in conjunction with a high-deductible health plan (HDHP). These plans typically have lower monthly premiums but higher deductibles. The money saved on premiums can be put towards the HSA, creating a dedicated fund for medical expenses.

To illustrate the benefits of an HSA, here’s a breakdown of how it works:

Benefits of an HSA 1. Tax-Deductible Contributions Individuals can lower their taxable income by depositing funds into an HSA. 2. Tax-Free Withdrawals Funds in an HSA can be used tax-free for qualified medical expenses. 3. Triple Tax Advantage HSAs provide a tax break on contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

With an HSA, individuals have control over their healthcare funds. They can choose how much to contribute, how to invest the funds, and when to use them for medical expenses. It’s a flexible and tax-efficient way to save for healthcare costs in retirement.

It’s important to consult with a financial advisor or tax professional to understand the specific rules and regulations surrounding HSAs and to determine if it’s the right option for your unique financial situation.

Diversifying with Alternative Investments

In addition to traditional investments, individuals can explore alternative investment options within their IRAs, such as mutual funds and brokerage services. This includes the ability to invest in alternative assets such as gold, bitcoin, and other cryptocurrencies. These alternative investment options introduce diversification and the potential for higher returns within a retirement account.

Diversification is a key strategy for IRAs. By diversifying your portfolio, you spread out your investments across different asset classes, reducing the impact of market volatility and potentially increasing the overall return on your investment. Alternative investments, such as gold IRAs, bitcoin IRAs, and cryptocurrency IRAs, provide unique opportunities for diversification.

Gold IRA: A gold IRA allows you to invest in physical gold, such as gold bars or coins, within your retirement account. Gold has long been considered a safe haven asset, with the potential to act as a hedge against inflation and economic uncertainty. Including gold in your IRA can provide stability and diversification to your overall retirement portfolio.

Bitcoin IRA and Cryptocurrency IRA: a novel account that integrates technological innovation into your retirement savings accounts. With the rise of cryptocurrencies like Bitcoin, individuals now have the option to invest in digital currencies within their IRAs. While these investments come with higher volatility and risk, they also offer the potential for significant returns. Including Bitcoin or other cryptocurrencies in your IRA can add a level of growth potential and technological innovation to your investment strategy, turning your IRA account into a tax-advantaged investment account focusing on future technologies.

It’s important to note that investing in alternative assets within an IRA may come with specific rules and regulations, so it’s crucial to consult with a financial advisor or IRA custodian to ensure compliance. Additionally, alternative investments may require specialized knowledge and expertise. Therefore, it’s advisable to seek guidance from professionals familiar with the specific asset class you are interested in.

Benefits of Alternative Investments in IRAs:

- Diversification of your retirement portfolio

- Potential for higher returns

- Opportunity to invest in unique assets

- Protection against inflation and economic uncertainty (in the case of gold)

- Exposure to new and innovative technologies (in the case of cryptocurrencies)

“By including alternative investments like gold, bitcoin, and other cryptocurrencies in your IRA, you can diversify your retirement portfolio and potentially increase your overall returns.”

As with any investment, it’s essential to understand the risks involved and conduct thorough research before allocating funds to alternative assets. While these investments can offer exciting opportunities, they may not be suitable for everyone, and individual circumstances should be taken into account.

Understanding Contribution Limits

When it comes to saving for retirement, it’s important to understand the contribution limits for different types of IRAs. The IRS sets specific limits for annual contributions, which may vary based on factors such as age, income, and employment status.

Traditional IRA Contribution Limits

For traditional IRAs, the maximum contribution limit for 2021 is $6,000 for individuals under the age of 50. However, individuals who are 50 years or older can make catch-up contributions of an additional $1,000, bringing the total limit to $7,000.

Roth IRA Contribution Limits

Roth IRAs also have a maximum contribution limit of $6,000 for individuals under 50 years old. Just like traditional IRAs, individuals who are 50 years or older can make catch-up contributions of an extra $1,000, allowing them to contribute up to $7,000.

Catch-Up Contributions

Catch-up contributions are available to individuals who are age 50 or older. This provision allows them to contribute additional funds to their IRAs above the regular annual limits. Catch-up contributions allow individuals to boost their retirement savings in the years leading up to retirement.

It’s important to note that these contribution limits are subject to change. To ensure you are aware of the current limits, consult the IRS website or speak with a financial advisor.

Maximizing Your Retirement Savings

Understanding and adhering to contribution limits is essential to maximize your retirement savings. By making regular contributions within the set limits, you can take advantage of the tax benefits and potential growth opportunities offered by both traditional and Roth IRAs. Consider reviewing your retirement plan regularly to ensure you are contributing the maximum amount allowed and making the most of your retirement savings journey.

Maximizing Tax Advantages

One of the key benefits of Individual Retirement Accounts (IRAs) is the array of tax advantages they offer. Whether it’s through tax-deductible contributions in traditional IRAs or tax-free withdrawals in Roth IRAs, understanding and utilizing these advantages can significantly boost your retirement savings.

Contributions made to traditional IRAs are often tax-deductible, which means you can potentially reduce your taxable income in the year you make the contribution. This deduction can lead to lower tax liabilities, effectively increasing the amount of money you can invest in your retirement. However, it’s important to note that the deductibility of contributions may be subject to income limits and employer-sponsored retirement plans.

On the other hand, Roth IRAs provide tax-free withdrawals in retirement. Since contributions to Roth IRAs are made with after-tax money, the earnings within the account can grow tax-free. This means that when you withdraw funds from your Roth IRA during retirement, you won’t owe any taxes on those funds. The tax-free nature of these withdrawals can be a significant advantage, providing you with a potentially larger pool of funds to support your retirement lifestyle.

By strategically choosing between traditional and Roth IRAs, individuals can optimize their tax advantages based on their current and future tax circumstances. Factors such as income level, tax rate, and retirement goals should be considered when determining which type of IRA to utilize.

Maximizing Deductions

In addition to the tax advantages offered by IRAs, there are other deductions that individuals can take advantage of to further enhance their retirement savings. For example, self-employed individuals who contribute to SEP IRAs can deduct their contributions as a business expense, reducing their overall taxable income. This deduction can provide a valuable opportunity for self-employed individuals to save for retirement while minimizing their tax burden.