Hearing loss can greatly affect different areas of life, such as the choice to retire. A study has shown that retirement is more common among people with hearing loss than those without it. Yet, after considering factors like age, gender, self-reported health, and history of chronic illness, there is no notable disparity in retirement rates between the two groups.

Key Takeaways:

- Hearing impairment can influence the decision to retire, but it is not the sole determinant.

- Retirement rates are not significantly different between individuals with and without hearing impairment.

- The average age at retirement in the United States has been increasing due to various factors, including changes in Social Security policies and the aging population.

- Deaf-friendly senior living communities provide tailored programs and accommodations for hearing-impaired individuals.

- Resources such as Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are available to assist deaf and hearing-impaired seniors.

The Impact of Hearing Loss on Retirement Decisions.

Retirement decisions are influenced by various factors, and hearing loss is one such factor that can play a role in this process. A study conducted on retirement rates and hearing impairment found that individuals with hearing impairment had a higher rate of retirement compared to those without. However, it’s essential to consider other factors such as age, gender, and health when exploring this association.

The study revealed that participants with hearing impairment were less likely to state that the main reason for retirement was that the time seemed right. This suggests that hearing impairment may impact the decision to retire, but it is not the sole determinant. The decision to retire is influenced by a combination of personal, financial, and health-related factors.

To fully understand the impact of hearing loss on retirement decisions, it is necessary to consider the overall context of an individual’s life, including their financial situation, social support networks, and personal goals. Retirement planning for individuals with hearing loss should involve holistic assessments and personalized strategies to ensure a successful transition into this new phase of life.

The Growing Aging Population and Hearing Loss.

In recent years, the average retirement age in the United States has been on the rise. Various factors, such as changes in Social Security policies and the need for health insurance coverage through employment, have contributed to this trend. Additionally, the aging population, particularly the baby boomer generation, is playing a significant role in the workforce, extending the retirement age.

With age, the prevalence of hearing loss tends to increase, making it a common issue among older individuals. As the baby boomer generation reaches retirement age, the number of people in the workforce with hearing impairment is expected to rise. This has important implications for retirement planning and the overall well-being of the aging population.

Retirement planning is crucial for ensuring financial security and a comfortable lifestyle during the later years of life. However, the presence of hearing loss adds an extra dimension to this process. It requires individuals to consider the potential impact of hearing impairment on their ability to work, communicate effectively, and navigate daily life in retirement.

As the aging population continues to grow, it is essential for individuals, families, and retirement planners to address the specific needs and challenges associated with hearing loss. This includes ensuring access to appropriate healthcare services, assistive devices, and support systems that can enhance the quality of life for seniors with hearing impairment.

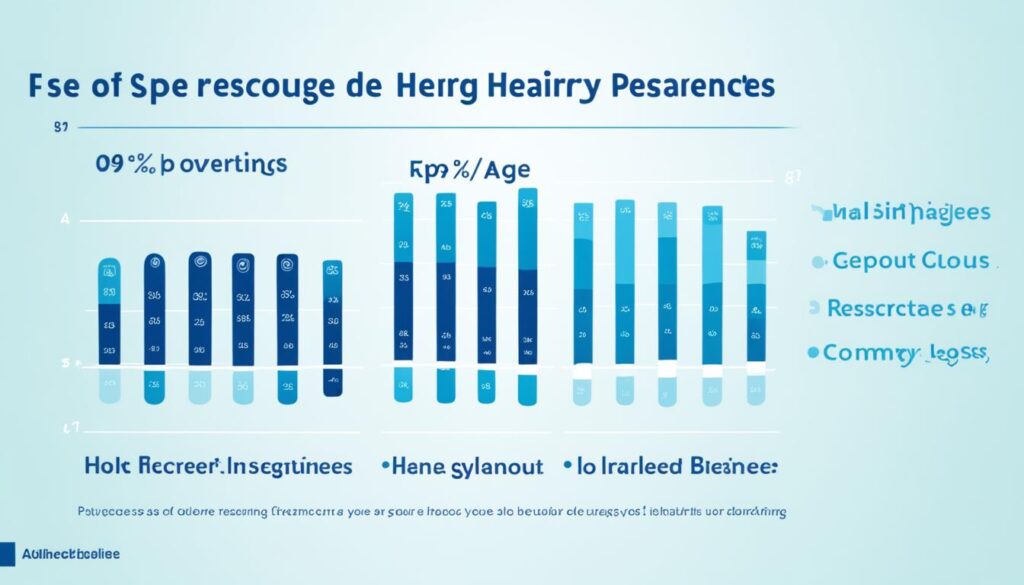

To gain a better understanding of the relationship between the aging population, hearing loss, and retirement age, let’s take a look at the following table:

| Age Group | Hearing Loss Prevalence | Retirement Age |

|---|---|---|

| 50-59 | 20% | 65 |

| 60-69 | 40% | 67 |

| 70+ | 50% | 70 |

This table highlights the increasing prevalence of hearing loss as individuals age, coupled with the corresponding retirement age. It demonstrates the need for tailored retirement planning strategies that account for the specific challenges faced by the aging population with hearing impairment.

By acknowledging and addressing the impact of hearing loss on retirement decisions, we can ensure that individuals have the necessary resources and support to plan for their financial, social, and emotional well-being in their later years.

Challenges of Hearing Loss in the Workplace.

As individuals gradually experience hearing loss, they may encounter several challenges in the workplace. Communication difficulties can arise, particularly in settings with background noise or when interacting with a large number of people. These challenges can have a significant impact on job performance and overall well-being.

One of the primary challenges faced by hearing-impaired individuals is the difficulty in understanding conversations or instructions. Background noise can make it especially challenging to discern speech, leading to misunderstandings and confusion. This can result in errors, delays, or incomplete tasks, ultimately affecting productivity and job performance.

Moreover, communication difficulties can also give rise to frustration, anxiety, and fatigue among hearing-impaired workers. Constantly straining to hear and understand conversations can be mentally and physically exhausting, impacting overall job satisfaction and morale. The increased effort required to communicate effectively can leave employees feeling drained, causing burnout and reducing their motivation.

“In a noisy work environment, keeping up with conversations can be incredibly challenging. I often find myself asking co-workers to repeat themselves, which can be frustrating for both parties.” – Employee testimonial

The Impact on Performance

The combination of communication difficulties and the resulting fatigue can significantly contribute to a decline in job performance for hearing-impaired individuals. This can manifest in various ways, such as missed deadlines, decreased accuracy, and reduced efficiency. The inability to effectively participate in meetings or team discussions can also hinder collaboration and limit career progression opportunities.

Additionally, the challenges faced by hearing-impaired individuals may lead to increased stress levels and feelings of isolation in the workplace. This can create a negative work environment, impacting not only the individual but also their colleagues and team dynamics.

Addressing the Challenges

Employers can play a crucial role in supporting employees with hearing loss and mitigating these challenges. Implementing the following strategies can help create a more inclusive and supportive work environment:

- Providing reasonable accommodations, such as assistive listening devices or captioning services, to facilitate effective communication.

- Implementing noise reduction measures in the workplace, such as soundproofing or designating quiet areas for important conversations.

- Offering training programs to increase awareness and understanding of hearing loss among staff members.

- Encouraging open communication and creating a culture of inclusivity that values diverse abilities and perspectives.

By addressing the challenges of hearing loss in the workplace, employers can create a more supportive environment that benefits all employees and promotes productivity and job satisfaction.

| Challenges | Impact | Recommended Strategies |

|---|---|---|

| Communication difficulties | Missed instructions, misunderstandings, reduced productivity | Providing assistive devices, implementing noise reduction measures |

| Fatigue and frustration | Decreased job satisfaction, increased stress levels | Offering training programs, creating an inclusive culture |

| Decline in performance | Missed deadlines, decreased accuracy, limited career progression | Providing reasonable accommodations, encouraging open communication |

Deaf-Friendly Senior Living Communities.

Deaf-friendly senior living communities offer a supportive and inclusive living environment for older adults with hearing impairment. These communities are designed to cater to the unique needs of the hearing-impaired population, providing a range of accommodations and services to ensure comfort and engagement.

One of the key features of these communities is the availability of tailored programs that address the needs and interests of hearing-impaired individuals. These programs may include sign language classes, communication workshops, and social activities specifically designed to foster interactions and connections among residents.

Trained staff proficient in sign language play a crucial role in deaf-friendly senior living communities. They are equipped to effectively communicate with residents, ensuring clear and meaningful interactions. This enables hearing-impaired individuals to express their needs, concerns, and preferences without any barriers.

By creating an environment where communication is accessible and embraced, deaf-friendly senior living communities empower residents to engage actively and maintain a sense of independence.

The amenities provided in these communities are specifically designed to accommodate the unique needs of hearing-impaired individuals. These accommodations may include visual alarms and notification systems, touch-friendly technology interfaces, and assistive devices such as amplified telephones and personal listening systems.

The focus of deaf-friendly senior living communities is not only on addressing the physical challenges of hearing impairment but also on creating a supportive social environment. These communities encourage residents to actively participate in social activities, fostering a sense of belonging and reducing feelings of isolation often associated with hearing loss.

Benefits of Deaf-Friendly Senior Living Communities

Deaf-friendly senior living communities offer numerous benefits to their residents. These include:

- Socialization: By providing opportunities for interaction and socialization, these communities combat the potential isolation that often accompanies hearing loss. Residents can form friendships, share experiences, and engage in meaningful social activities.

- Mental well-being: Social engagement and a sense of belonging contribute to improved mental health among hearing-impaired individuals. These communities create a supportive environment where residents can maintain positive emotional and psychological well-being.

- Physical safety: Deaf-friendly senior living communities prioritize safety by incorporating visual alarms, emergency communication systems, and other measures to ensure the physical well-being of their residents.

Overall, deaf-friendly senior living communities offer a holistic approach to senior living accommodations for individuals with hearing impairment. By addressing both the specific needs of the hearing-impaired population and providing a supportive and inclusive environment, these communities enable residents to enjoy their retirement years to the fullest.

Social and Health Benefits of Deaf-Friendly Senior Living.

Deaf-friendly senior living communities provide a supportive and inclusive environment for seniors with hearing impairments. These communities offer a range of social and health benefits that contribute to a better quality of life for their residents.

Social Benefits

One of the key advantages of deaf-friendly senior living is the emphasis on fostering social interaction and engagement among residents. These communities provide numerous opportunities for individuals to connect with others who share similar experiences and challenges. Regular social activities, such as group outings, game nights, and community events, enable residents to build friendships and cultivate a sense of belonging.

Moreover, living in a community that understands the unique communication needs of the hearing-impaired opens doors for increased socialization. With trained staff proficient in sign language and accessible communication methods, residents can actively participate in conversations, expressing themselves freely and engaging in meaningful exchanges.

Health Benefits

Besides the positive impact on social well-being, deaf-friendly senior living communities promote better overall health for their residents. These communities prioritize safety and accessibility, reducing the risk of falls and injuries. With features such as wheelchair ramps, handrails, and well-designed living spaces, seniors with hearing difficulties can navigate their environment confidently and independently.

Furthermore, research suggests that social engagement and mental stimulation can help prevent cognitive decline and reduce the risk of dementia in older adults. Deaf-friendly senior living communities provide a rich environment for creative expression and mental engagement through activities like art classes, music therapy, and educational programs.

Healthcare resources specific to the needs of hearing-impaired seniors are readily available within these communities. On-site hearing clinics, access to hearing aids, and support from specialized healthcare professionals ensure that residents receive the necessary care and support for their hearing difficulties.

“Deaf-friendly senior living communities provide a safe and supportive environment for seniors with hearing impairments, offering both social and health benefits.”

Overall, the social and health benefits of deaf-friendly senior living communities contribute to improved well-being and a higher quality of life for seniors with hearing impairments. By creating an inclusive environment that encourages social interaction and enhances physical and mental health, these communities empower older adults to thrive and enjoy their retirement years to the fullest.

| Benefits of Deaf-Friendly Senior Living | Social Benefits | Health Benefits |

|---|---|---|

| Encourages interaction and socializing among residents | ✓ | |

| Fosters creative expression through various activities | ✓ | |

| Promotes better mental health by combating isolation | ✓ | |

| Reduces the risk of falls and injuries | ✓ | |

| Helps prevent cognitive decline and reduce the risk of dementia | ✓ | |

| Provides necessary resources for seniors with hearing difficulties | ✓ |

Types of Senior Living for Hard-of-Hearing Adults.

For hard-of-hearing adults, there are various types of senior living options tailored to meet their unique needs. These options include deaf assisted living facilities, deaf independent living facilities, deaf skilled nursing facilities, adult daycare for hard-of-hearing adults, and home health care and aids.

Deaf assisted living facilities provide round-the-clock care and support for individuals with hearing impairment. These facilities offer personalized assistance with daily activities, medication management, and specialized programs designed to enhance the quality of life for deaf residents.

Deaf independent living facilities, on the other hand, cater to hard-of-hearing individuals who desire a greater level of independence. These facilities provide accessible accommodations, such as visual alarm systems, with an emphasis on maintaining privacy and autonomy while offering support when needed.

Deaf skilled nursing facilities are suitable for those with more complex medical needs. These facilities have trained healthcare professionals who specialize in caring for individuals with hearing impairments. They provide comprehensive medical care, rehabilitation services, and therapy tailored to meet the unique needs of hard-of-hearing residents.

In addition to these living options, adult daycare programs specifically designed for hard-of-hearing adults offer a supportive environment where individuals can socialize, engage in enriching activities, and receive personalized care during the day while returning home in the evenings.

For hard-of-hearing adults who prefer to remain in their own homes, home health care services and aids are available. These services include skilled nursing care, assistance with daily living activities, and the provision of assistive devices and technologies to support independent living.

Benefits of Different Senior Living Options for the Hard-of-Hearing

Each type of senior living facility for hard-of-hearing adults offers unique benefits and accommodations. Deaf assisted living facilities provide a supportive community and personalized care for those who require assistance in their daily lives.

Deaf independent living facilities promote independence, self-sufficiency, and a sense of belonging while ensuring accessibility and safety for residents with hearing impairments.

Deaf skilled nursing facilities provide specialized medical care and rehabilitation services, offering comprehensive support for individuals with complex healthcare needs.

Adult daycare programs for hard-of-hearing adults foster socialization, engagement, and personalized care, enabling individuals to maintain an active and fulfilling lifestyle.

Home health care services and aids allow hard-of-hearing individuals to receive personalized care in the comfort of their own homes, promoting independence and meeting their specific healthcare needs.

| Type of Senior Living | Services and Accommodations |

|---|---|

| Deaf Assisted Living | – Round-the-clock care and support – Assistance with daily activities – Medication management – Specialized programs |

| Deaf Independent Living | – Accessible accommodations – Visual alarm systems – Emphasis on privacy and autonomy |

| Deaf Skilled Nursing Facilities | – Comprehensive medical care – Rehabilitation services – Specialized therapy |

| Adult Daycare for Hard-of-Hearing Adults | – Socialization and engagement – Enriching activities – Personalized care during the day |

| Home Health Care and Aids | – Skilled nursing care – Assistance with daily living activities – Provision of assistive devices and technologies |

Amenities in Deaf-Friendly Senior Living Communities.

Deaf-friendly senior living communities prioritize the comfort and safety of residents with hearing impairment, providing a wide range of amenities and services to cater to their unique needs.

Fluent American Sign Language (ASL) Staff

One of the key amenities in these communities is the availability of staff members who are fluent in American Sign Language (ASL). This ensures effective communication and allows residents to express their needs and preferences without any barriers. Having ASL fluent staff creates a welcoming environment where residents can feel understood and valued.

Emergency Communication Systems

To ensure residents’ safety, deaf-friendly senior living communities are equipped with advanced emergency communication systems. These systems include visual alarm signals and flashing lights in case of fire or other emergencies, providing crucial alerts to residents who may not rely on auditory cues. This allows for prompt evacuation and enhances overall safety within the community.

Hearing Aids and Assistive Devices

Access to hearing aids and other assistive devices is another essential amenity provided in these communities. Hearing aids can significantly improve the quality of life for residents with hearing loss by enhancing their ability to perceive and understand speech. Additionally, assistive devices such as closed-captioned televisions, amplified phones, and personal listening systems are available to further support communication and engagement.

These amenities in deaf-friendly senior living communities create a supportive and inclusive environment for residents with hearing impairment, promoting their overall well-being and quality of life.

| Amenities | Description |

|---|---|

| Fluent ASL Staff | Staff members proficient in American Sign Language for effective communication and understanding. |

| Emergency Communication Systems | Visual alarm signals and flashing lights to ensure residents’ safety during emergencies. |

| Hearing Aids and Assistive Devices | Access to hearing aids and assistive devices to enhance communication and engagement. |

Average Costs of Deaf Senior Living.

When considering senior living options for deaf and hearing-impaired individuals, it’s essential to understand the average costs associated with different types of facilities and levels of care. The cost of senior living can vary depending on factors such as location, amenities provided, and the level of support necessary.

Here is a breakdown of the average costs for deaf senior living:

| Type of Facility | Average Cost per Year |

|---|---|

| Deaf Independent Living | $42,000 |

| Assisted Living for Deaf Seniors | $45,000 |

| Nursing Homes for Deaf or Skilled Nursing Facilities | $85,000 |

It’s important to note that these figures are averages and can vary depending on factors such as the location of the facility and the specific services and amenities provided. Additionally, financial assistance programs and insurance coverage may be available to help offset these costs.

When considering the costs of senior living for deaf individuals, it’s crucial to assess personal financial resources, explore potential assistance options, and consider long-term financial planning to ensure a comfortable and sustainable living arrangement.

Choosing a Deaf-Friendly Assisted Living Facility.

When it comes to selecting an assisted living facility for individuals with hearing impairment, several essential factors should be considered. A deaf-friendly facility ensures a comfortable and inclusive living environment for seniors, providing the necessary support and accommodations they need.

The availability of trained staff proficient in sign language is key. Having staff members who are fluent in sign language allows for effective communication and enhances the overall experience for residents. They can understand and respond to the needs of hearing-impaired individuals, fostering a sense of connection and community.

Deaf-friendly architecture is another crucial aspect to consider. Buildings and rooms designed with the needs of hearing-impaired individuals in mind make it easier for them to navigate and interact within the facility. Features such as visual cue systems, well-lit spaces, and assistive technology can greatly enhance communication and ensure safety.

Technological advancements play a significant role in creating a deaf-friendly environment. The use of devices such as video relay services, captioned telephones, and vibrating alert systems can greatly improve communication accessibility for residents. These innovations enable individuals with hearing impairment to stay connected with their loved ones and the outside world.

Lastly, the understanding of deaf culture among the staff and management is crucial. A deaf-friendly facility embraces the unique cultural aspects of the deaf community and creates an inclusive atmosphere that respects their identity, language, and traditions.

By carefully considering these factors and choosing an assisted living facility with a focus on being deaf-friendly, individuals with hearing impairment can find a community that meets their specific needs and enhances their overall quality of life.

Resources for Deaf and Hearing-Impaired Seniors.

Deaf and hearing-impaired seniors have access to various resources that provide financial, medical, and educational assistance. These resources are designed to support individuals in overcoming the challenges they may face and ensuring they have the necessary support to lead fulfilling lives. Some of the key resources available include:

- Social Security Disability Insurance (SSDI): SSDI provides financial assistance to individuals with disabilities who are no longer able to work due to their condition. Deaf and hearing-impaired seniors may be eligible for SSDI benefits, which can help alleviate financial burdens.

- Supplemental Security Income (SSI): SSI is a needs-based program that provides assistance to individuals with limited income and resources. Eligibility for SSI benefits is determined based on various factors, including disability status. Deaf and hearing-impaired seniors who meet the criteria may qualify for SSI benefits.

- State Agencies: Many states have agencies and organizations dedicated to supporting individuals with hearing loss. These organizations can provide valuable information on services and programs available at the local level, including financial assistance, vocational training, and rehabilitation services.

- Medicaid Coverage for Hearing Services: Medicaid, a joint state and federal program, provides healthcare coverage to eligible individuals, including hearing-related services. Deaf and hearing-impaired seniors can explore Medicaid options to access necessary hearing aids, assistive devices, and other related services.

- Department of Veterans Affairs (VA): For veterans with hearing loss, the VA offers a range of benefits and support services. These may include audiology services, hearing aids, and assistive devices, ensuring veterans have access to the necessary resources to manage their hearing impairment effectively.

Additionally, there are various programs and initiatives aimed at providing education and training opportunities for deaf and hearing-impaired individuals. These programs focus on building skills, enhancing employability, and fostering independence.

By tapping into these resources and support systems, deaf and hearing-impaired seniors can access the assistance they need to navigate challenges, improve their quality of life, and confidently embrace their golden years.

Statistics about the Hard of Hearing.

Studies and research provide valuable insights into the prevalence of hearing loss in the United States. It is estimated that approximately 48 million people in the country experience some degree of hearing loss, which translates to around 15% of the population.

Furthermore, the prevalence of hearing loss increases with age, with approximately one in three people over the age of 65 experiencing some form of hearing impairment. As the population continues to age, experts predict a rise in the number of individuals affected by hearing loss.

The statistics emphasize the challenges faced by those who are hard of hearing. For example, individuals with hearing loss may encounter difficulties in the workplace, ranging from communication barriers to job discrimination. Limited access to healthcare and education can further compound the challenges faced by this population.

It is crucial to raise awareness about the impact of hearing loss and advocate for inclusive environments that support the needs of the hard of hearing community. By addressing these challenges, we can work towards a more inclusive society that embraces and empowers individuals with hearing loss.

Job Discrimination and the ADA.

The Americans with Disabilities Act (ADA) is a federal law that prohibits employment discrimination based on disability, including hearing loss. Under the ADA, employers are required to provide reasonable accommodations to employees with disabilities, including individuals with hearing loss, to ensure equal opportunity and access in the workplace.

Reasonable accommodations for employees with hearing loss can include:

- Providing sign language interpreters for meetings or training sessions

- Offering assistive technology, such as hearing aids or captioning services

- Modifying job duties or work schedules as necessary

These accommodations can help individuals with hearing loss effectively communicate and perform their job responsibilities. By providing these accommodations, employers can create a more inclusive and accessible work environment for all employees.

If an employee believes they have experienced discrimination based on their hearing loss, they have the right to file a complaint with the Equal Employment Opportunity Commission (EEOC), which enforces the ADA. The EEOC investigates complaints of employment discrimination and may take legal action on behalf of the employee if necessary.

The ADA’s protections extend to all aspects of employment, including hiring, firing, promotions, and job assignments. By promoting equal opportunity and requiring reasonable accommodations, the ADA aims to prevent discrimination and ensure that individuals with hearing loss have equal access to employment opportunities.

Key points:

– The Americans with Disabilities Act (ADA) prohibits employment discrimination based on disability, including hearing loss.

– Employers are required to provide reasonable accommodations for employees with hearing loss.

– Reasonable accommodations can include sign language interpreters, assistive technology, and modifications to job duties.

– Employees who believe they have experienced discrimination can file a claim with the Equal Employment Opportunity Commission (EEOC).

Additional Resources:

Resource Description Social Security Disability Insurance (SSDI) Provides financial assistance to individuals with disabilities, including those with hearing loss, who are unable to work. Supplemental Security Income (SSI) Offers additional financial support to low-income individuals with disabilities, including individuals with hearing loss. Department of Veterans Affairs Provides benefits and services to veterans with hearing loss, including rehabilitation, hearing aids, and assistive devices.

Benefits Available to the Hard of Hearing.

Hard-of-hearing individuals have access to various benefits and assistance programs that can support their needs and improve their quality of life. These benefits can help with the financial costs of managing hearing loss and provide resources for rehabilitation and assistive technology. Two key programs that individuals may be eligible for are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

1. Social Security Disability Insurance (SSDI)

SSDI is a federal program that provides income support to individuals who have a disability, including those with hearing loss. To qualify for SSDI benefits, individuals must have worked and earned enough credits to be eligible for Social Security benefits. Additionally, they must meet the Social Security Administration’s definition of disability, which includes having a medically determinable impairment that prevents them from engaging in substantial gainful activity.

2. Supplemental Security Income (SSI)

SSI is a needs-based program that provides cash assistance to individuals with disabilities who have limited income and resources. It is administered by the Social Security Administration and can provide financial support to eligible individuals with hearing loss. To qualify for SSI benefits, individuals must meet the program’s income and resource limits, as well as the definition of disability.

State Agencies

In addition to federal programs like SSDI and SSI, state agencies also play a role in providing assistance to individuals with hearing loss. These agencies may offer programs and services such as vocational rehabilitation, education and training, assistive technology, and support for acquiring hearing aids or other communication devices. Each state has its own agencies and programs, so it’s important to reach out to the relevant state agency to explore available resources.

“Access to benefits such as Social Security Disability Insurance and Supplemental Security Income can provide vital support to individuals with hearing loss, helping them meet their financial needs and access necessary resources for rehabilitation and assistive technology.” – [Author Name]

By accessing these benefits and resources, hard-of-hearing individuals can receive the support they need to manage their hearing loss effectively. Whether it’s financial assistance, vocational training, or access to assistive technology, these programs can make a significant difference in their daily lives.

Conclusion.

Retirement planning can be a complex process for elderly individuals with hearing loss. However, there are resources and solutions available to support and empower seniors with hearing impairment throughout their retirement years. Deaf-friendly senior living communities offer tailored programs, trained staff proficient in sign language, and accommodations designed to meet the unique needs of hearing-impaired individuals. These communities provide a safe and stimulating environment, promoting social interaction and good mental health.

Additionally, various resources such as Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), and state agencies can provide financial assistance and access to hearing aids and assistive technology. By understanding the impact of hearing loss on retirement decisions and utilizing these resources, elderly individuals can navigate their retirement years with confidence and an improved quality of life.

Planning for retirement may present challenges for those with hearing loss, but with the right support and accommodations, elderly individuals can thrive in their retirement and enjoy all that life has to offer.